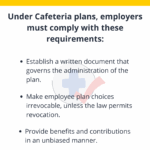

As an employer offering a Section 125 Plan, it is crucial to maintain compliance with IRS regulations to avoid penalties and fines. One key aspect of compliance is ensuring that all necessary documentation is in place, including the 125 Plan Compliance Form. This form serves as a record of the plan’s structure, eligibility requirements, contribution limits, and other important details that must be adhered to.

By completing and maintaining the 125 Plan Compliance Form, employers can demonstrate their commitment to following the rules set forth by the IRS and protect themselves from potential audits or penalties. It also provides employees with a clear understanding of their benefits and rights under the Section 125 Plan, fostering transparency and trust within the organization.

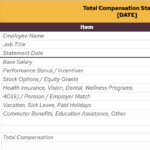

125 Plan Compliance Form

Steps to Complete the 125 Plan Compliance Form

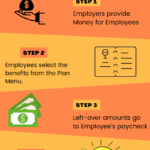

Completing the 125 Plan Compliance Form involves gathering information about the plan, such as the plan document, summary plan description, employee contributions, and other relevant details. Employers should ensure that all information provided is accurate and up-to-date to avoid any discrepancies or issues during an audit.

Once the form is completed, it should be reviewed by a qualified professional, such as a benefits consultant or tax advisor, to ensure compliance with IRS regulations. Employers should also keep a copy of the form on file for their records and provide a copy to employees participating in the plan to keep them informed of their rights and obligations.

Benefits of Maintaining Compliance with the 125 Plan

By maintaining compliance with the 125 Plan Compliance Form, employers can avoid potential penalties, fines, or audits by demonstrating their commitment to following IRS regulations. It also helps to protect the interests of employees by ensuring that they receive the benefits they are entitled to under the Section 125 Plan.

Overall, proper documentation and compliance with the 125 Plan Compliance Form are essential for employers to protect themselves and their employees, maintain transparency and trust within the organization, and avoid costly mistakes or penalties in the future.

Download 125 Plan Compliance Form

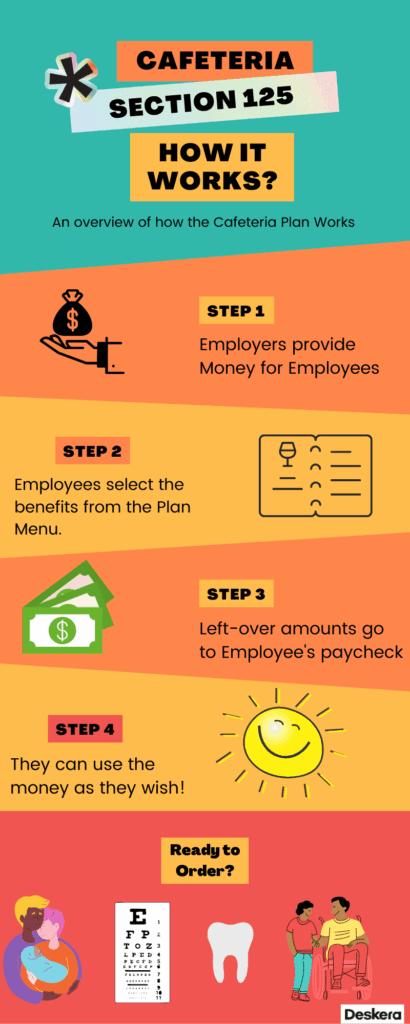

What Is The Section 125 Plan

What Is The Section 125 Plan