529 plans are a popular way for families to save for their children’s education expenses. In Illinois, residents have access to a variety of 529 plans to help them reach their savings goals. One important aspect of setting up a 529 plan in Illinois is filling out the necessary forms. These forms are essential for opening and managing a 529 plan account. Here are some of the key benefits of using 529 plan Illinois forms:

529 plan Illinois forms are designed to be user-friendly and easy to understand. They typically include step-by-step instructions on how to complete the forms, making the process of setting up a 529 plan account simple and straightforward. By using these forms, you can ensure that you are providing all the necessary information to open and manage your 529 plan account effectively.

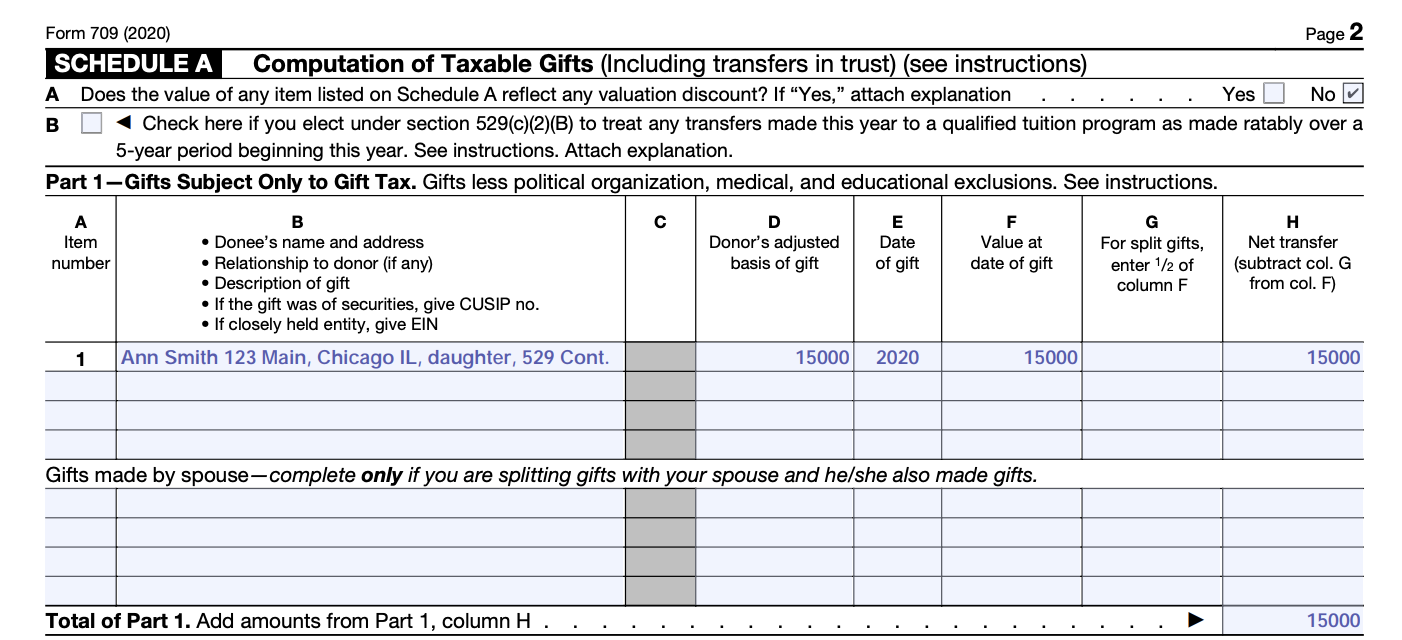

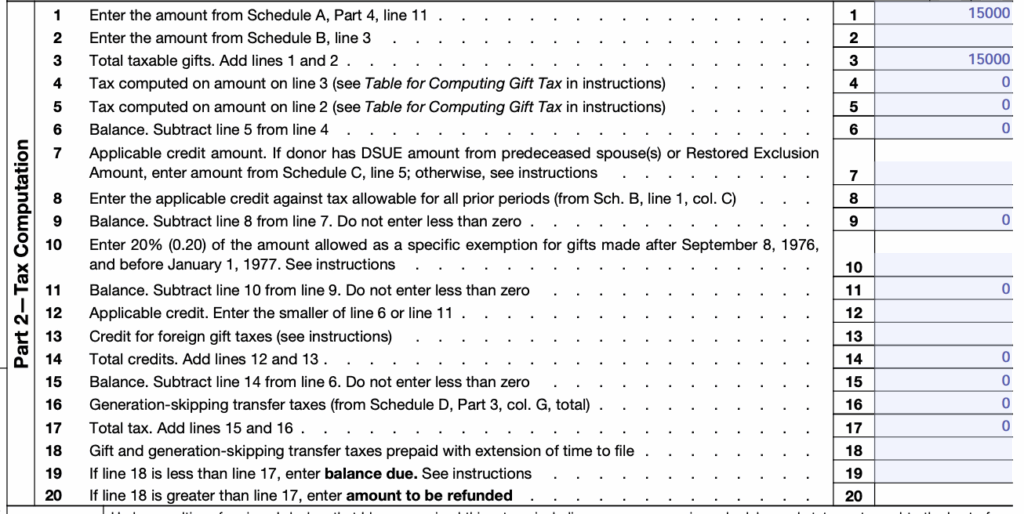

529 Plan Illinois Forms

Compliance with State Regulations

By using 529 plan Illinois forms, you can ensure that you are complying with all the necessary state regulations and requirements when opening and managing your 529 plan account. These forms are specifically tailored to meet the rules and regulations set forth by the state of Illinois, helping you avoid any potential issues or complications down the line. By filling out these forms correctly, you can ensure that your 529 plan account remains in good standing and that you are eligible for any state-specific benefits or incentives.

Where to Find 529 Plan Illinois Forms

If you are interested in setting up a 529 plan in Illinois and need to access the necessary forms, there are several resources available to help you. You can typically find 529 plan Illinois forms on the website of the financial institution or plan provider that you choose to work with. Additionally, you may be able to obtain these forms directly from the state of Illinois website or through your financial advisor. Be sure to carefully review and complete all required forms to ensure that your 529 plan account is set up correctly and in compliance with state regulations.