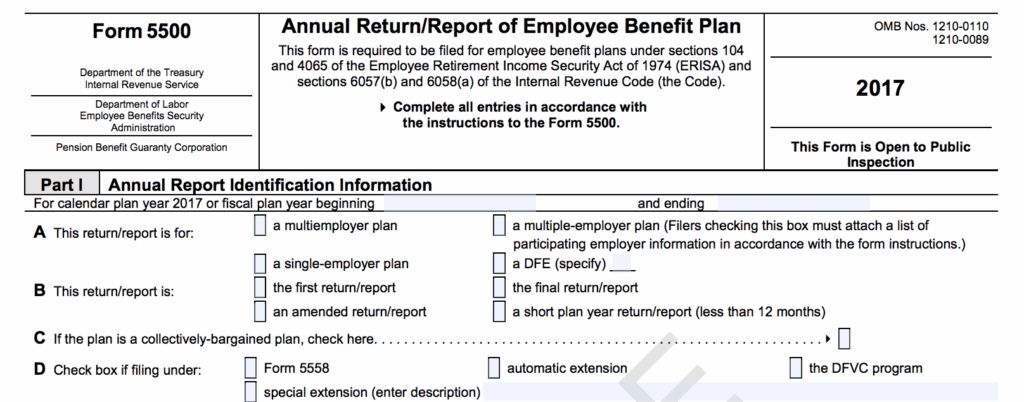

Form 5500 is a required annual report that must be filed by employee benefit plans to provide information on the plan’s financial condition, investments, and operations. For single employer plans, Form 5500 is used to report information on the plan’s contributions, assets, liabilities, and participant data. Filing Form 5500 is essential for compliance with the Employee Retirement Income Security Act (ERISA) and the Internal Revenue Code.

When it comes to single employer plans, Form 5500 provides valuable insights into the plan’s financial health and compliance with regulatory requirements. Plan sponsors must ensure accurate and timely filing of Form 5500 to avoid penalties and ensure transparency in their plan’s operations. By providing detailed information on the plan’s assets, liabilities, and participant data, Form 5500 helps regulators, participants, and other stakeholders understand the plan’s financial condition and compliance with ERISA requirements.

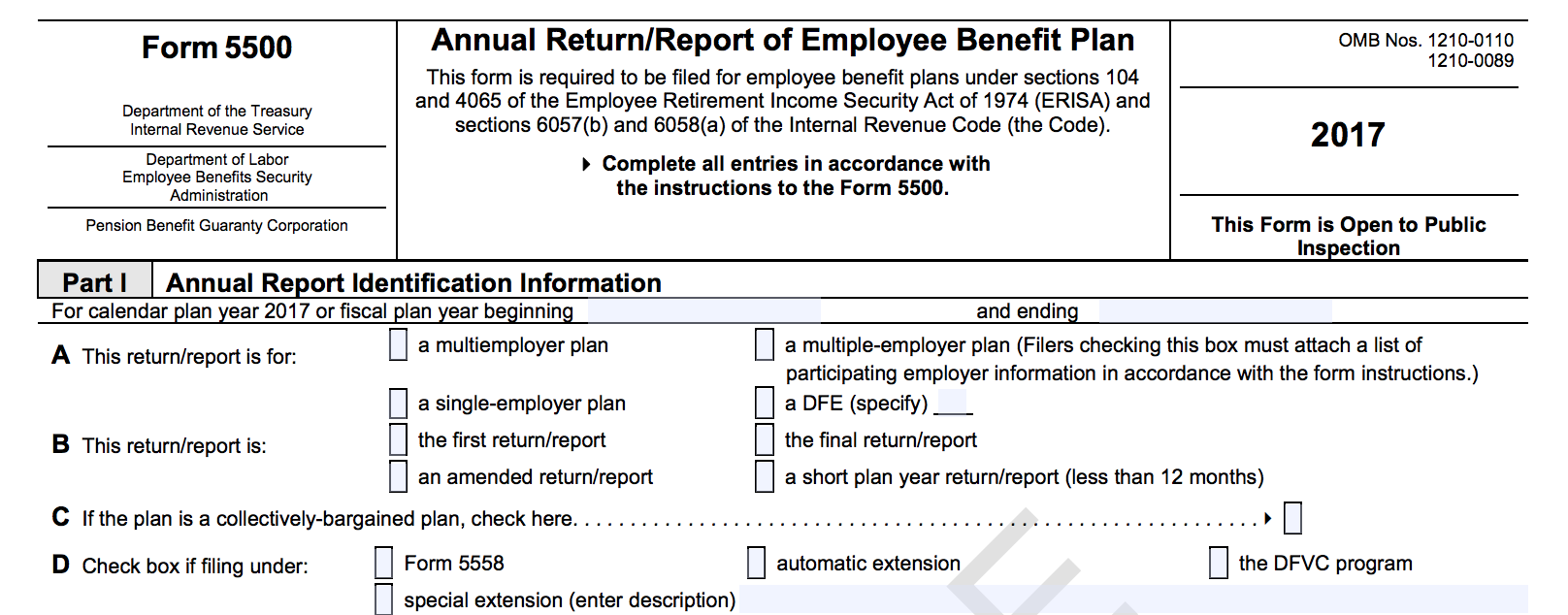

Form 5500 Single Employer Plan

Key Information Required in Form 5500 for Single Employer Plans

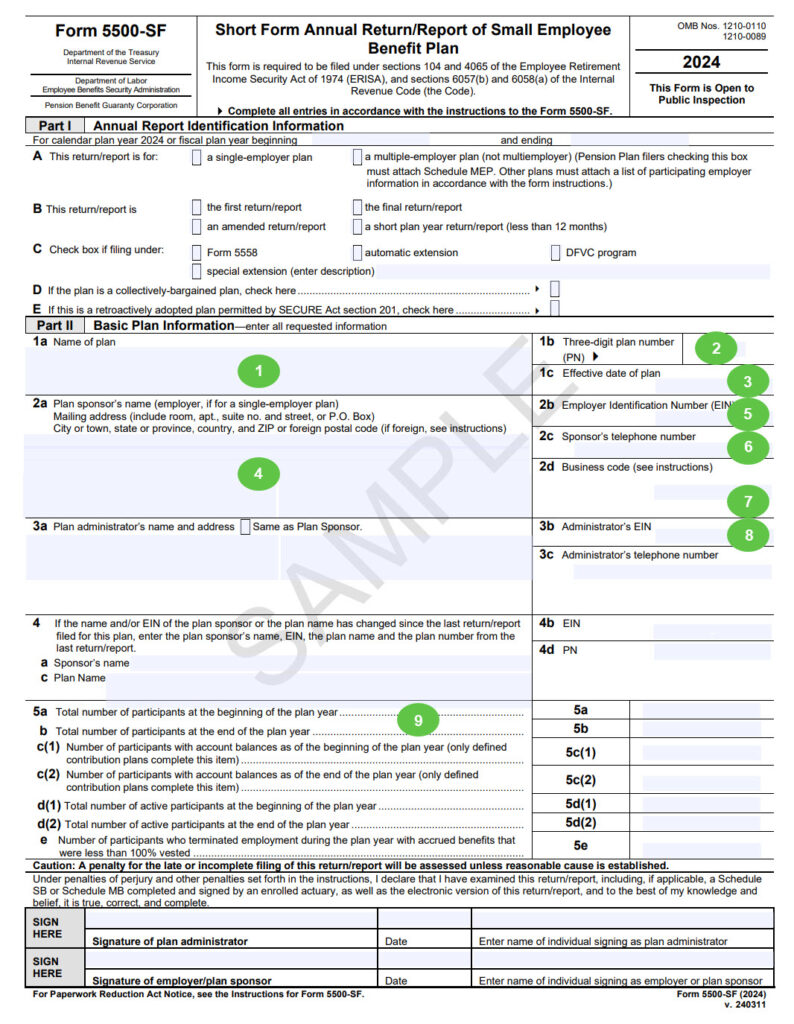

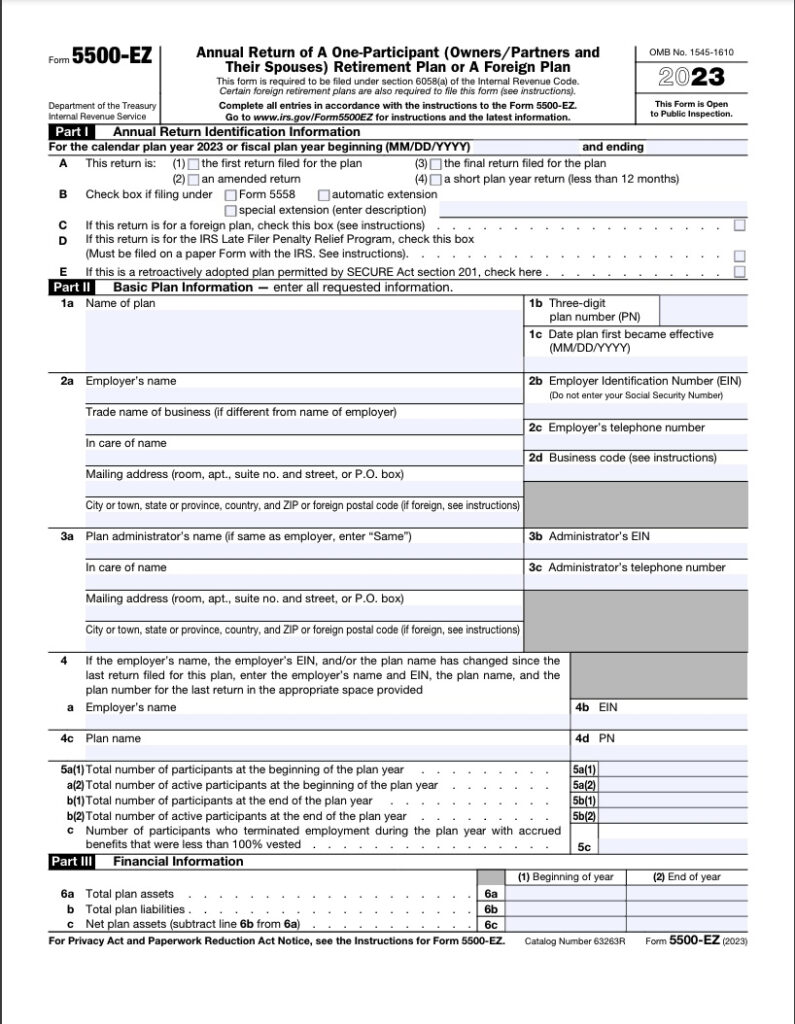

For single employer plans, Form 5500 requires detailed information on the plan’s contributions, assets, liabilities, and participant data. Plan sponsors must provide information on the plan’s funding status, investment performance, and participant demographics. Additionally, Form 5500 requires information on the plan’s service providers, such as investment managers, recordkeepers, and third-party administrators.

Plan sponsors must also provide information on any changes to the plan’s operations, such as amendments to the plan document or changes in plan administration. By accurately reporting this information on Form 5500, plan sponsors demonstrate compliance with ERISA requirements and provide transparency to participants and regulators. Filing Form 5500 for single employer plans is a crucial step in ensuring the financial health and regulatory compliance of the plan.

Conclusion

Form 5500 is a critical tool for single employer plans to report important information on their financial condition and compliance with regulatory requirements. By accurately completing and filing Form 5500, plan sponsors demonstrate transparency in their plan’s operations and provide valuable information to participants, regulators, and other stakeholders. Plan sponsors must ensure timely and accurate filing of Form 5500 to avoid penalties and maintain compliance with ERISA requirements. Understanding the key information required in Form 5500 for single employer plans is essential for plan sponsors to fulfill their reporting obligations and ensure the financial health of their plans.

Download Form 5500 Single Employer Plan

How To Fill Out IRS Form 5500 EZ White Coat Investor

Form 5500 Instructions 5 Steps To Filing Correctly ForUsAll Blog