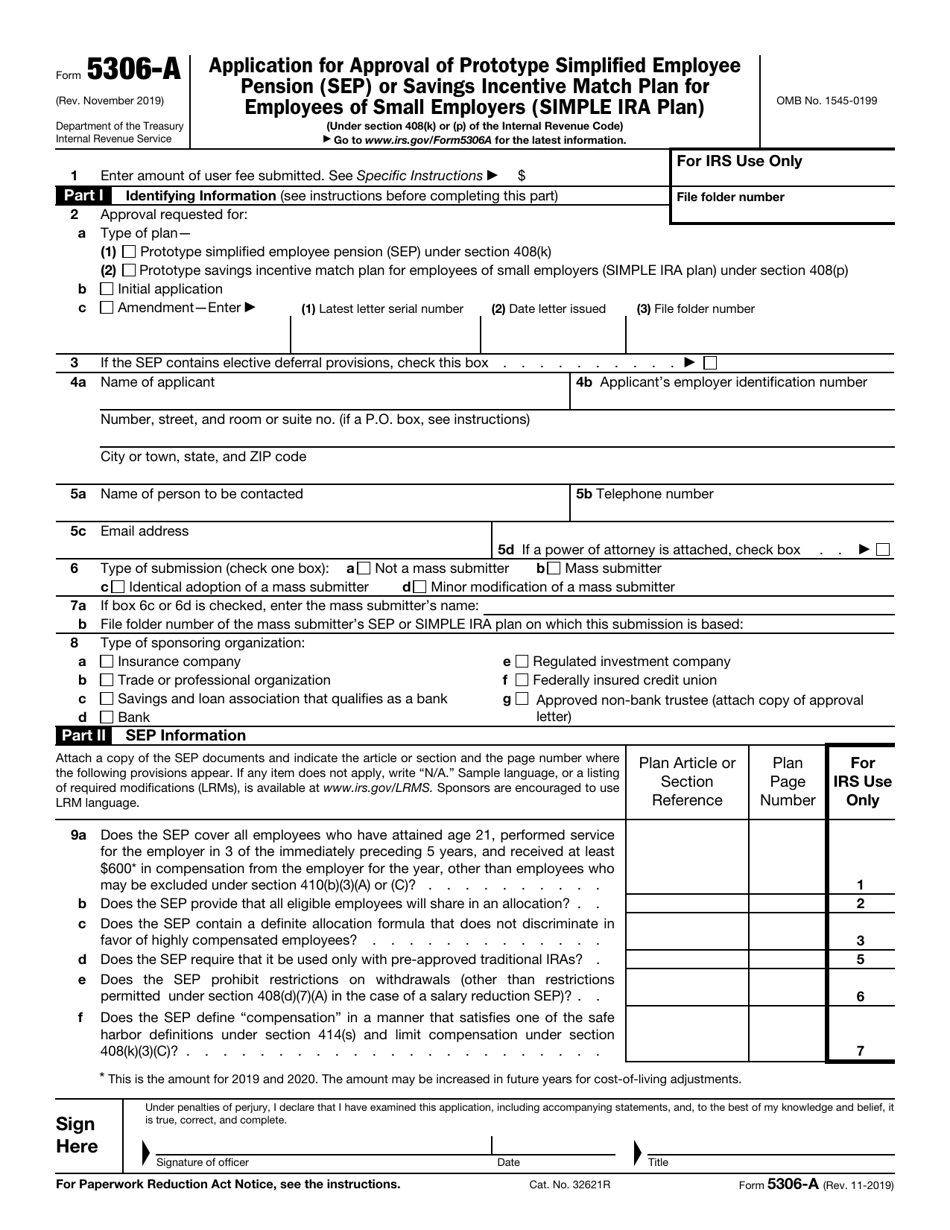

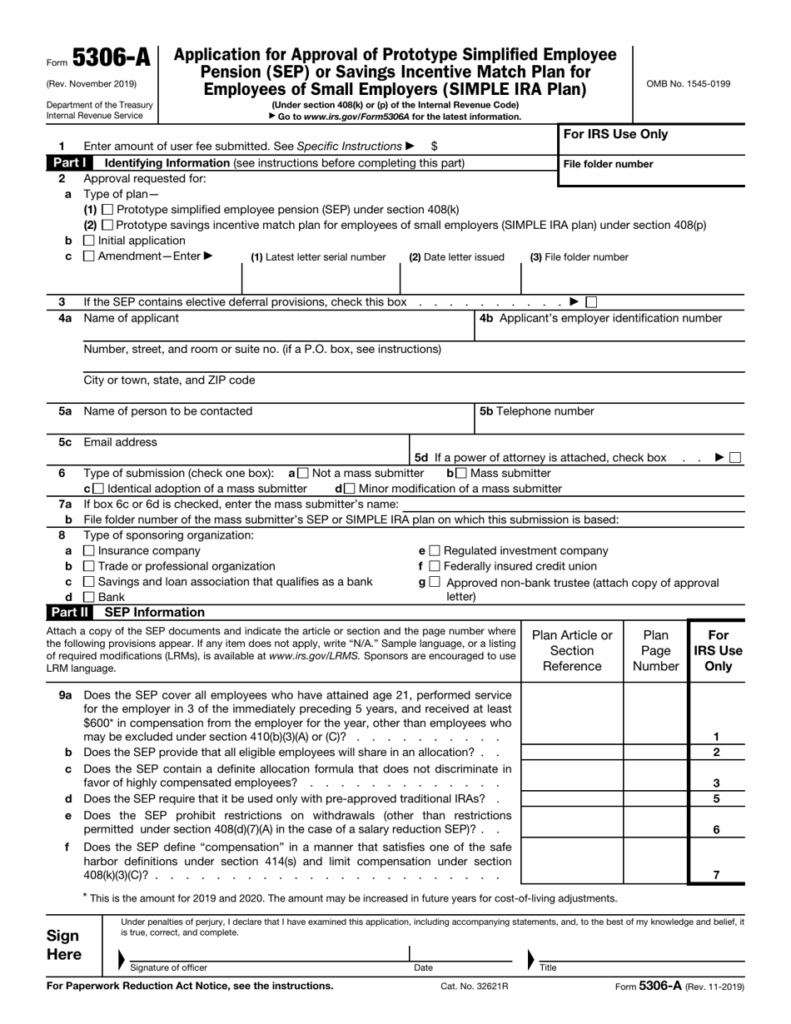

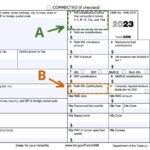

When it comes to retirement planning, a SEP IRA (Simplified Employee Pension Individual Retirement Account) can be a valuable tool for small business owners and self-employed individuals. One key component of setting up a SEP IRA is the plan document form. This document outlines the rules and regulations governing the SEP IRA, including eligibility requirements, contribution limits, and distribution rules.

Having a properly drafted SEP IRA plan document form is crucial for ensuring that your retirement plan complies with IRS regulations. It serves as a roadmap for how the plan operates and helps protect both the employer and employees by clearly outlining their rights and responsibilities.

Sep Ira Plan Document Form

How to Obtain a SEP IRA Plan Document Form

There are several ways to obtain a SEP IRA plan document form. One option is to work with a financial advisor or retirement plan specialist who can assist in setting up your SEP IRA and provide you with the necessary documentation. Another option is to use online resources or software programs that offer customizable plan document forms tailored to your specific needs.

It’s important to carefully review and understand the contents of the SEP IRA plan document form before signing it. Make sure that all the information is accurate and up to date, and that it reflects your retirement goals and objectives. Consulting with a legal or financial professional can help ensure that your SEP IRA plan document form meets all legal requirements and safeguards your retirement savings.

Benefits of a Well-Designed SEP IRA Plan Document Form

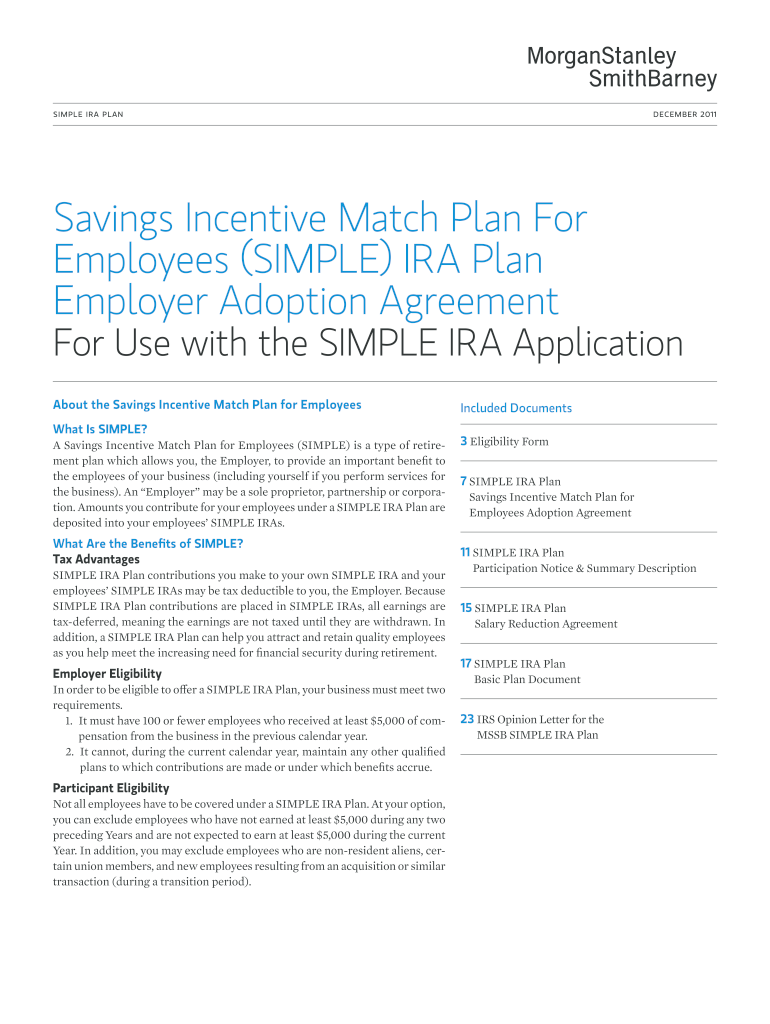

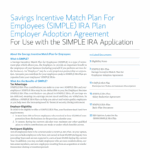

A well-designed SEP IRA plan document form can provide several benefits for both employers and employees. For employers, it can help attract and retain top talent by offering a competitive retirement benefit package. It also allows for flexibility in contribution amounts, making it easier to adjust to changing business conditions.

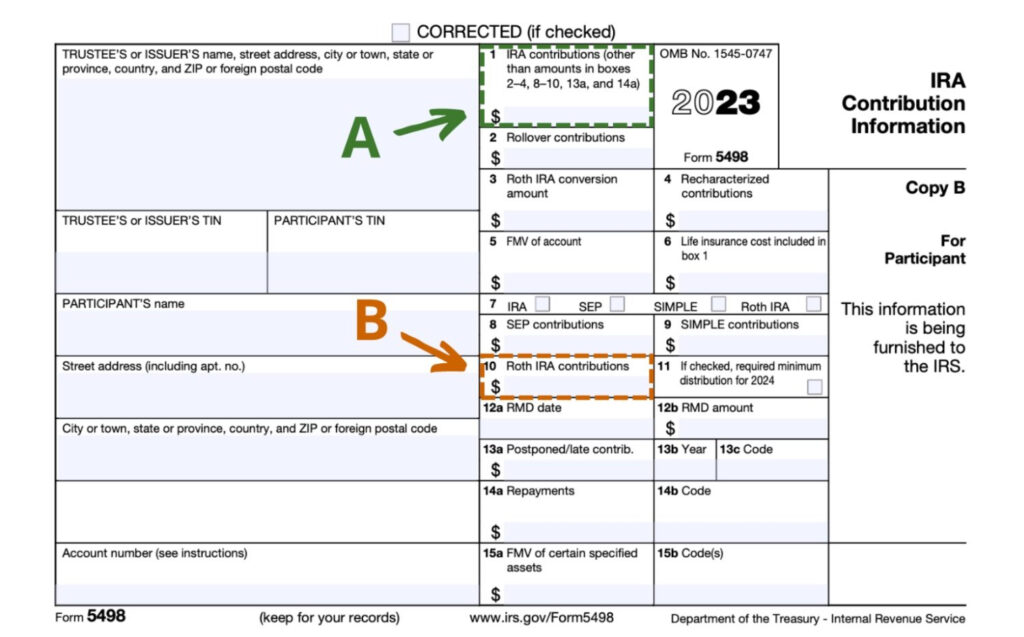

For employees, a SEP IRA plan document form provides a clear understanding of how their retirement plan works and what benefits they are entitled to. It also offers tax advantages, as contributions to a SEP IRA are tax-deductible, and earnings grow tax-deferred until withdrawal.

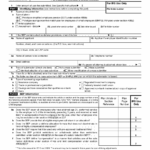

Download Sep Ira Plan Document Form

Morgan Stanley Sep Ira Fill Out Sign Online DocHub

IRS Form 5306 A Fill Out Sign Online And Download Fillable PDF Templateroller