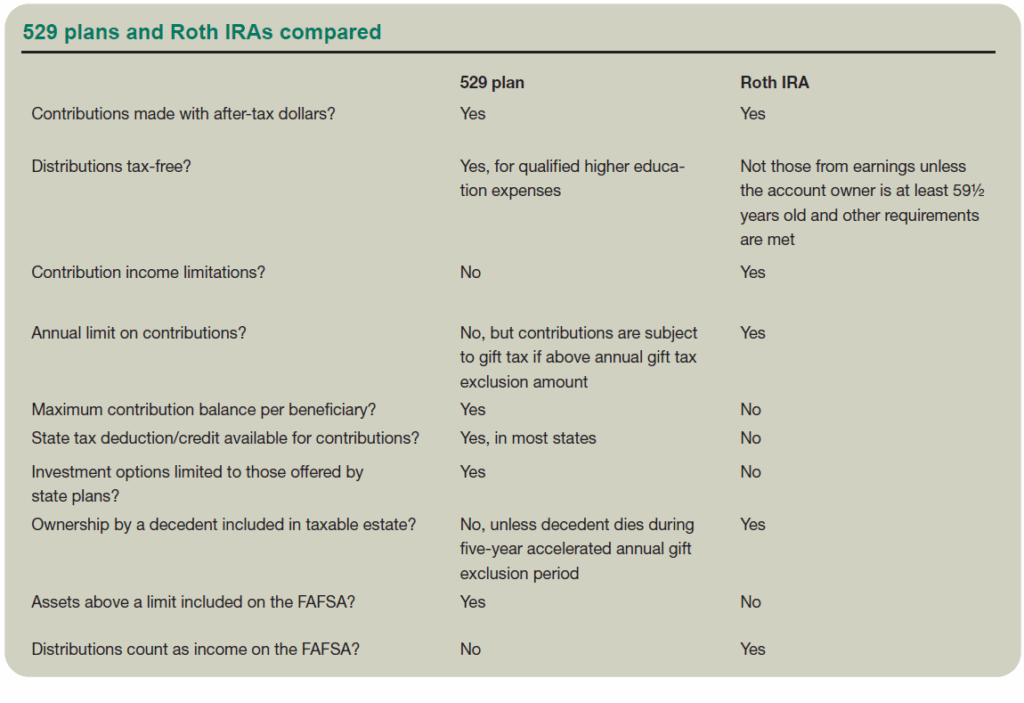

When it comes to saving for your child’s education, a 529 plan can be a valuable tool. Not only does it offer tax-free growth on your investments, but many states also offer a tax deduction for contributions made to the plan. This means that you can save for your child’s education while also reducing your tax burden each year.

Additionally, 529 plans offer flexibility in terms of how the funds can be used. While the primary purpose of the plan is to save for higher education expenses, the funds can also be used for K-12 education expenses, as well as for certain apprenticeship programs. This means that even if your child decides not to attend college, the funds in the 529 plan can still be put to good use.

529 Plan Tax Form Deduction

Understanding the Tax Form Deduction

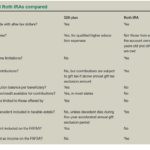

One of the key benefits of a 529 plan is the tax deduction that many states offer for contributions made to the plan. When you contribute to a 529 plan, you may be eligible to deduct a certain amount from your state income taxes each year. This can result in significant savings over time, especially if you are able to contribute regularly to the plan.

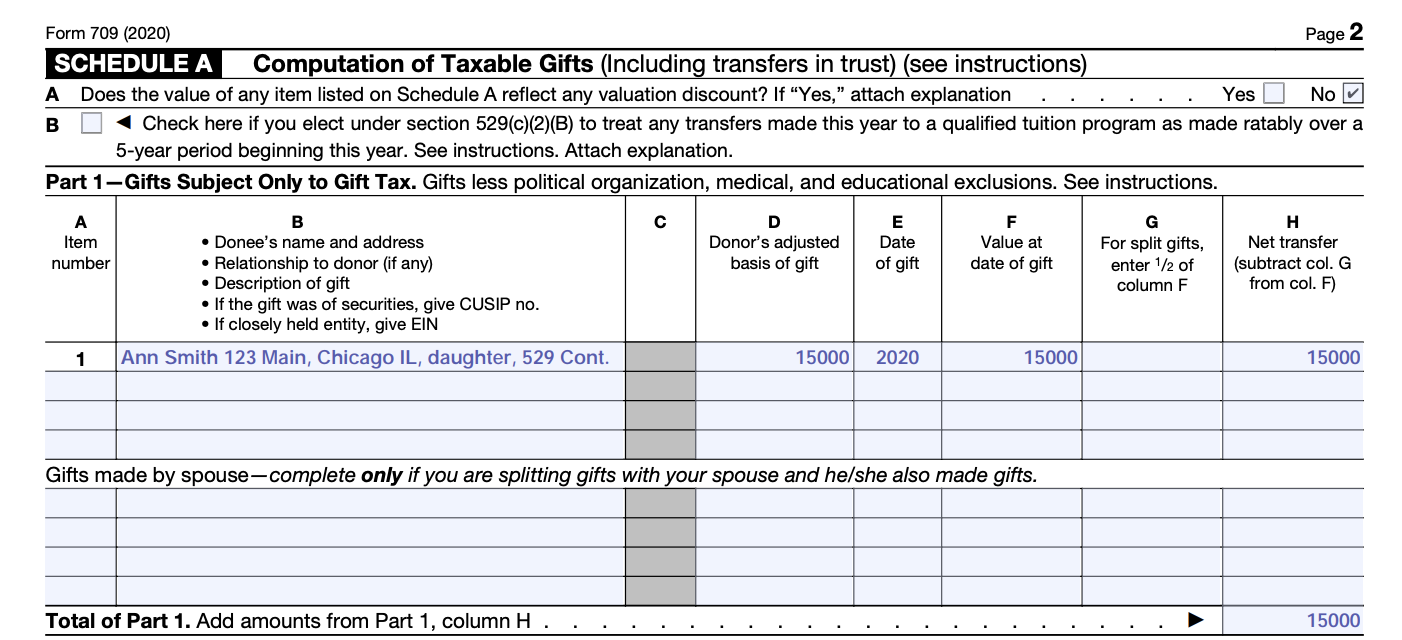

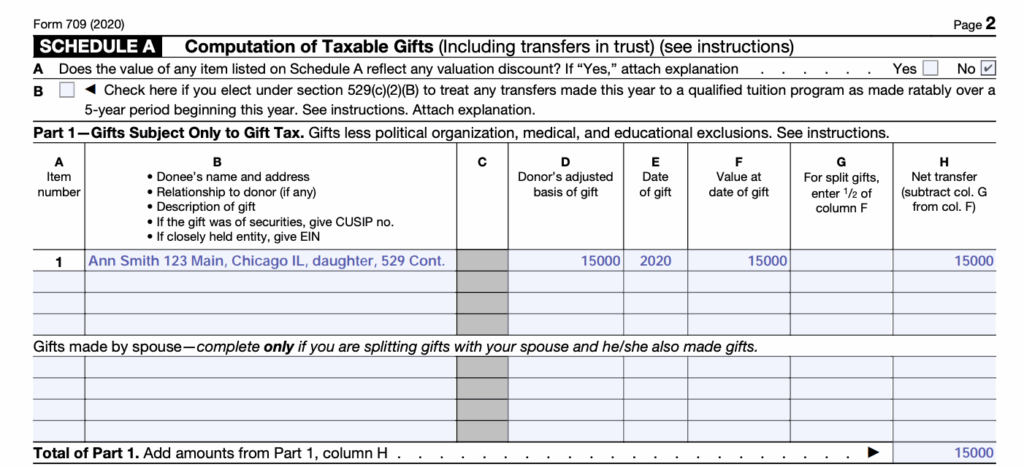

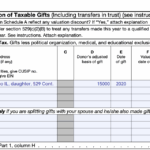

In order to claim the tax deduction for your 529 plan contributions, you will need to fill out the appropriate tax form when you file your state taxes. This form will typically ask for information such as the amount of your contributions to the plan, the account number of the 529 plan, and any other relevant information. Be sure to keep detailed records of your contributions throughout the year to make this process easier.

Maximizing Your Tax Savings

If you want to maximize your tax savings with a 529 plan, consider contributing the maximum amount allowed by your state each year. Some states offer a flat dollar amount deduction, while others offer a percentage-based deduction. By contributing the maximum amount allowed, you can ensure that you are taking full advantage of the tax benefits offered by your state.

It’s also important to remember that the tax benefits of a 529 plan are specific to state taxes. While contributions to a 529 plan are not deductible on your federal tax return, the tax-free growth and withdrawals for qualified education expenses make it a valuable tool for saving for your child’s education. Be sure to consult with a tax professional or financial advisor to fully understand how a 529 plan can benefit you and your family.

Download 529 Plan Tax Form Deduction

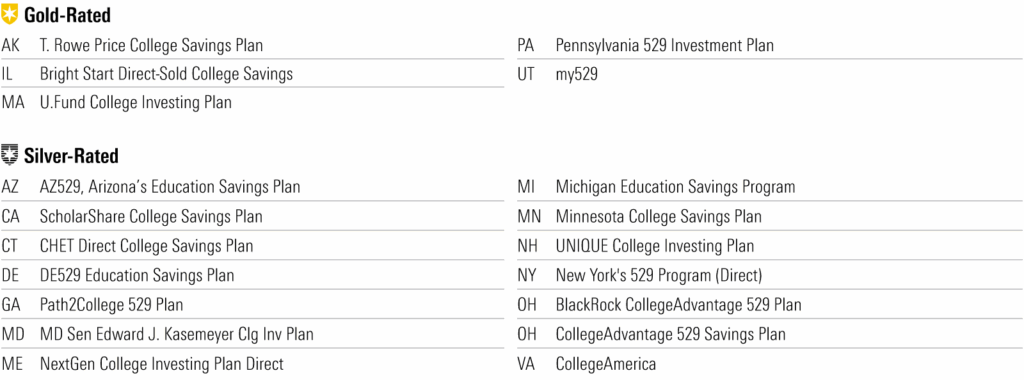

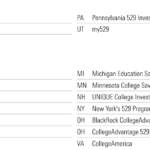

Understand Your 529 State Tax Benefits Morningstar

Superfund 529 Plan White Coat Investor