A Dividend Reinvestment Plan (DRIP) is a financial tool that allows investors to reinvest the cash dividends they receive from owning stocks back into the same company’s stock. By using a Dividend Reinvestment Plan Form, investors can easily set up automatic reinvestment of their dividends without having to manually reinvest each dividend payment.

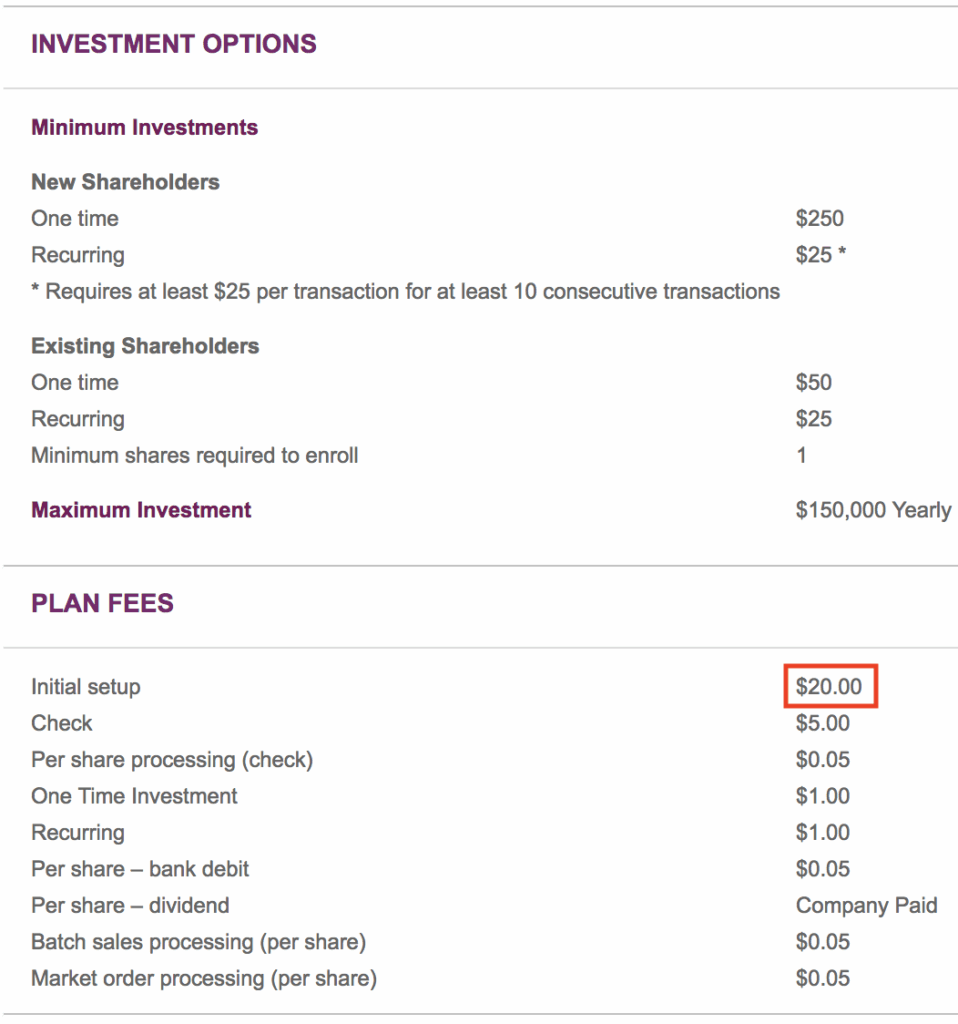

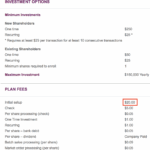

DRIPs are a popular way for investors to grow their investment portfolios over time, as the reinvested dividends can lead to compound growth. Additionally, many companies offer discounts or fee waivers for investors who participate in their DRIP programs, making it a cost-effective way to reinvest dividends.

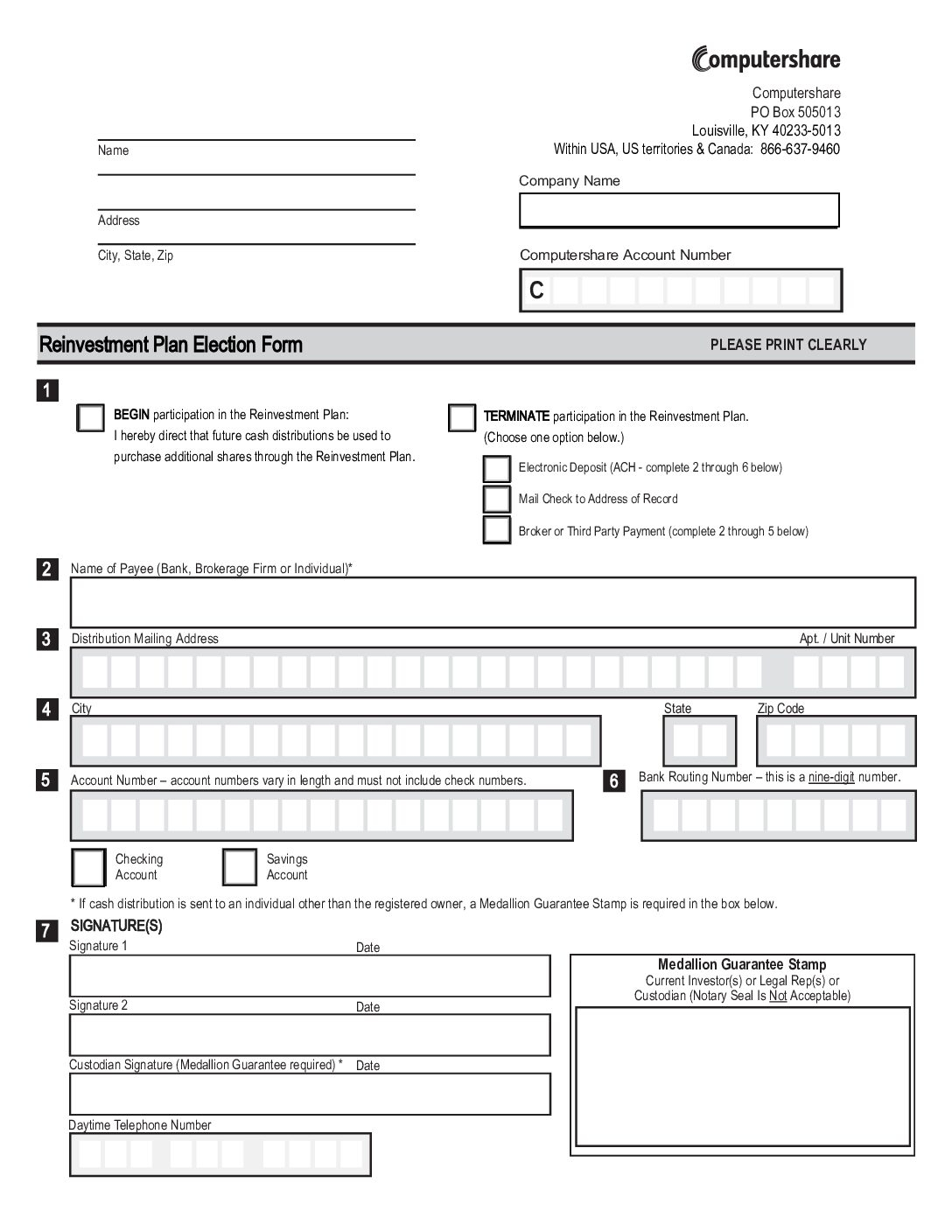

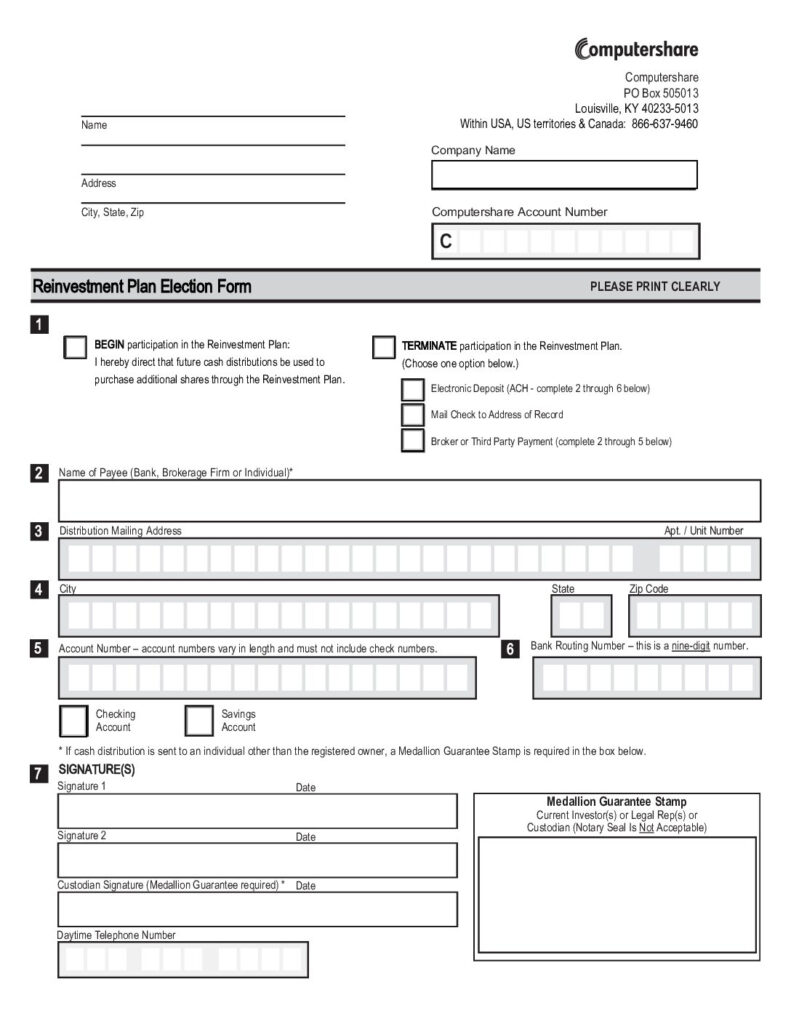

Dividend Reinvestment Plan Form

2. How to Use a Dividend Reinvestment Plan Form

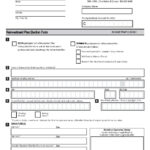

Using a Dividend Reinvestment Plan Form is a simple process that typically involves filling out a form provided by the company offering the DRIP program. Investors will need to provide information such as their name, address, account number, and the number of shares they wish to enroll in the DRIP program.

Once the form is completed and submitted to the company, investors will begin to automatically reinvest their dividends back into the company’s stock. Some companies may offer the option to reinvest dividends in partial shares, allowing investors to maximize their reinvestment without having to purchase whole shares.

3. The Advantages of Using a Dividend Reinvestment Plan Form

There are several advantages to using a Dividend Reinvestment Plan Form. One of the main benefits is the ability to compound returns over time, as reinvested dividends can generate additional shares that will also earn dividends. This can lead to significant growth in the long run, especially for investors with a long-term investment horizon.

Additionally, using a DRIP can help investors dollar-cost average their investments, as dividends are reinvested at the current market price. This can help mitigate the impact of market volatility and potentially increase returns over time. Overall, utilizing a Dividend Reinvestment Plan Form can be a valuable tool for investors looking to grow their wealth through dividend reinvestment.

By utilizing a Dividend Reinvestment Plan Form, investors can take advantage of the benefits of automatic dividend reinvestment and potentially grow their investment portfolios over time. Whether you are a seasoned investor or just starting out, consider using a DRIP program to maximize the power of compound growth and take control of your financial future.

Download Dividend Reinvestment Plan Form

Introduction Dividend Reinvestment Plan DRP DRIP Example Calculation No Money Lah

Reinvestment Plan Election Form