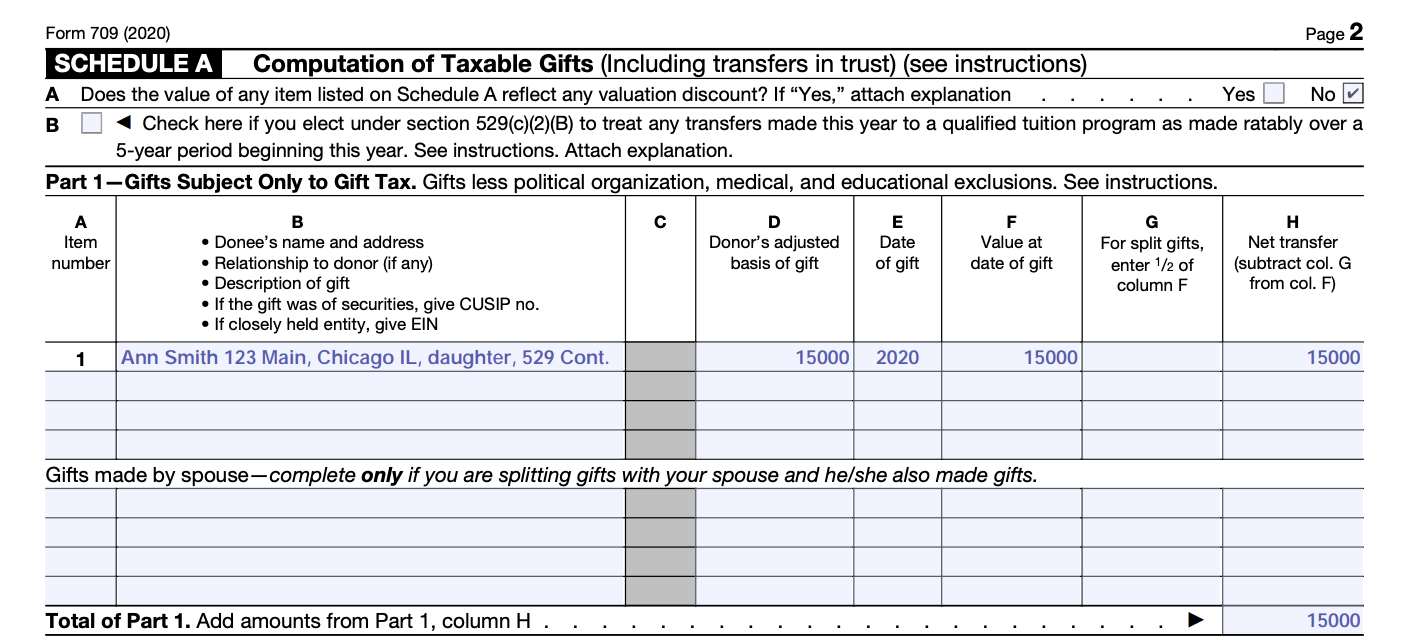

A 529 College Savings Plan is a tax-advantaged investment account that helps families save for future education expenses. Contributions to a 529 plan grow tax-free, and withdrawals for qualified education expenses are also tax-free. However, it is important to keep track of the tax forms associated with a 529 plan to ensure compliance with IRS regulations.

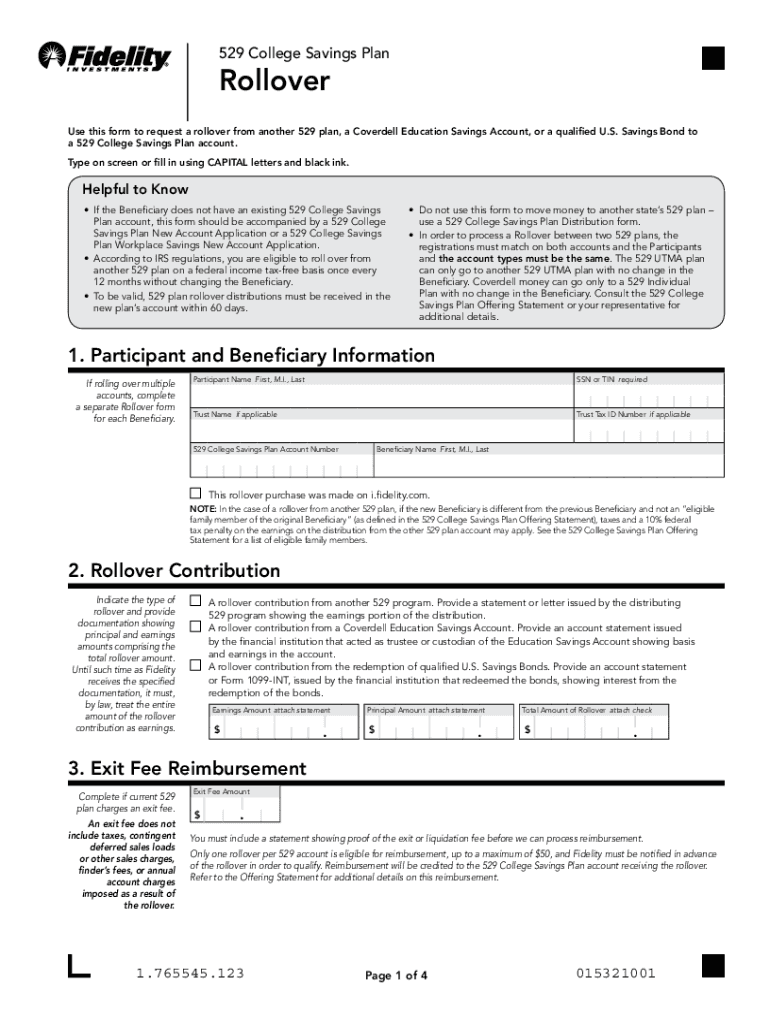

One key tax form related to a 529 plan is the IRS Form 1099-Q. This form is used to report distributions from a 529 plan and is typically issued by the plan administrator in January each year. The 1099-Q form will detail the total amount of withdrawals made from the plan during the tax year, as well as any earnings on those withdrawals.

529 College Savings Plan Tax Form

How to Use the 529 College Savings Plan Tax Form

When it comes time to file your taxes, you will need to include information from the 1099-Q form on your tax return. The earnings portion of the withdrawals made from a 529 plan may be subject to income tax and a 10% penalty if not used for qualified education expenses. By accurately reporting this information on your tax return, you can avoid any potential tax penalties.

It is important to note that the beneficiary of the 529 plan is typically the individual responsible for reporting the distributions on their tax return. If the beneficiary is a dependent, the parent or guardian claiming the dependent will need to include the information from the 1099-Q form on their tax return.

Conclusion

As you save for your child’s education with a 529 College Savings Plan, it is crucial to understand the tax implications and reporting requirements associated with the plan. By keeping track of the IRS Form 1099-Q and accurately reporting the information on your tax return, you can ensure compliance with IRS regulations and maximize the benefits of your 529 plan.