IRS Forms 529 Plans are tax-advantaged savings plans designed to help families save for future education expenses. These plans are sponsored by states, state agencies, or educational institutions and offer various tax benefits to encourage saving for education. There are two main types of 529 plans: college savings plans and prepaid tuition plans.

College savings plans allow families to save for a beneficiary’s higher education expenses, such as tuition, fees, books, and room and board. Prepaid tuition plans, on the other hand, allow families to prepay tuition at eligible educational institutions at today’s prices for use in the future.

Irs Forms 529 Plans

How to Use IRS Forms 529 Plans

When it comes to using IRS Forms 529 Plans, there are a few key steps to keep in mind. First, you’ll need to choose a 529 plan that best suits your needs and goals. Consider factors such as investment options, fees, and tax benefits when making your decision.

Next, you’ll need to designate a beneficiary for the plan. This can be anyone you choose, including yourself. Once you’ve set up the plan and designated a beneficiary, you can start making contributions to the account. These contributions are made with after-tax dollars, but the earnings on the account grow tax-free. When it comes time to use the funds for education expenses, withdrawals are also tax-free as long as they are used for qualified expenses.

Conclusion

IRS Forms 529 Plans are a valuable tool for families looking to save for future education expenses. By choosing the right plan, designating a beneficiary, and making regular contributions, you can take advantage of the tax benefits offered by these plans. Whether you opt for a college savings plan or a prepaid tuition plan, IRS Forms 529 Plans can help you achieve your education savings goals.

Download Irs Forms 529 Plans

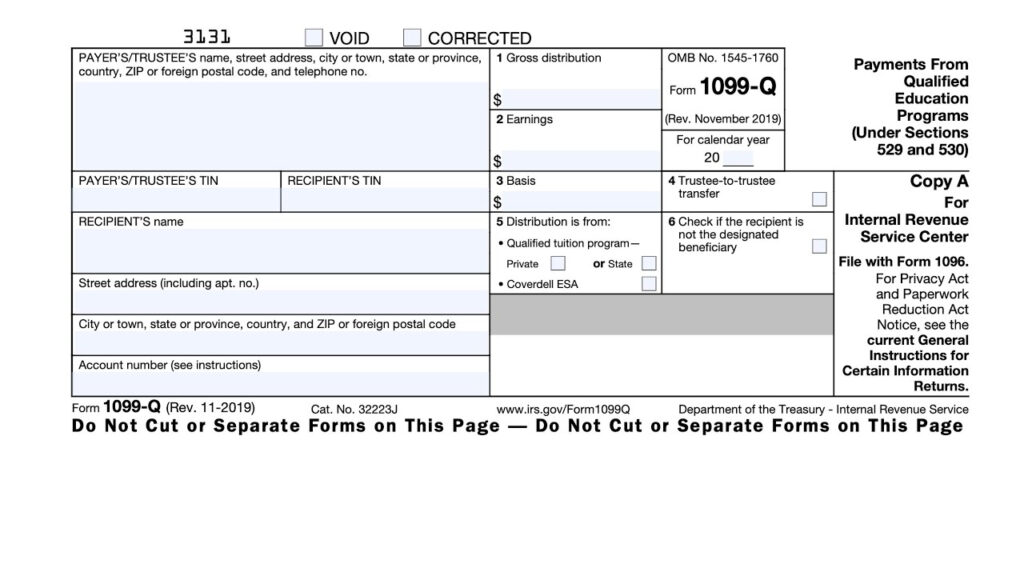

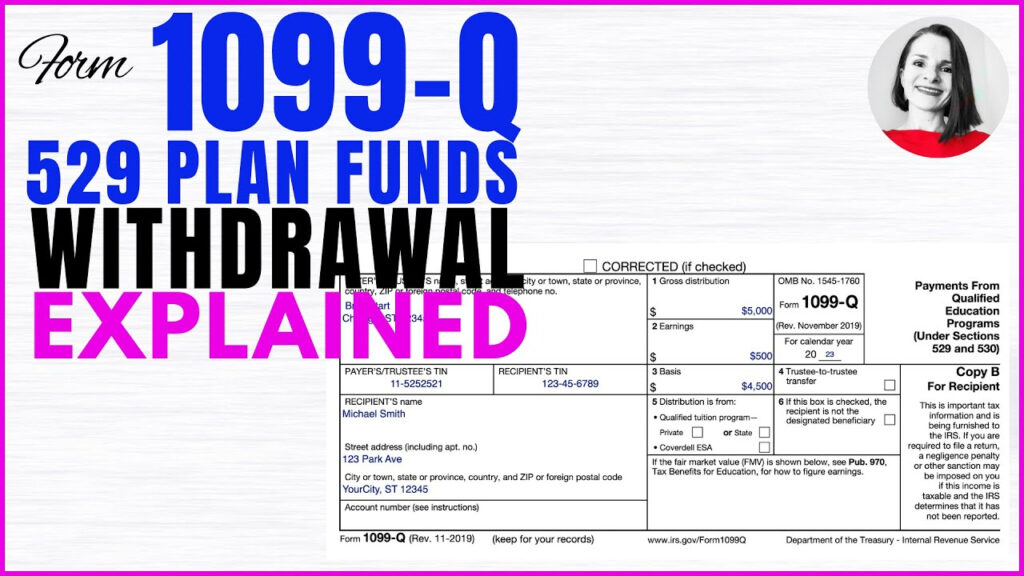

Tax Form 1099 Q Explained 529 Plan Withdrawal YouTube

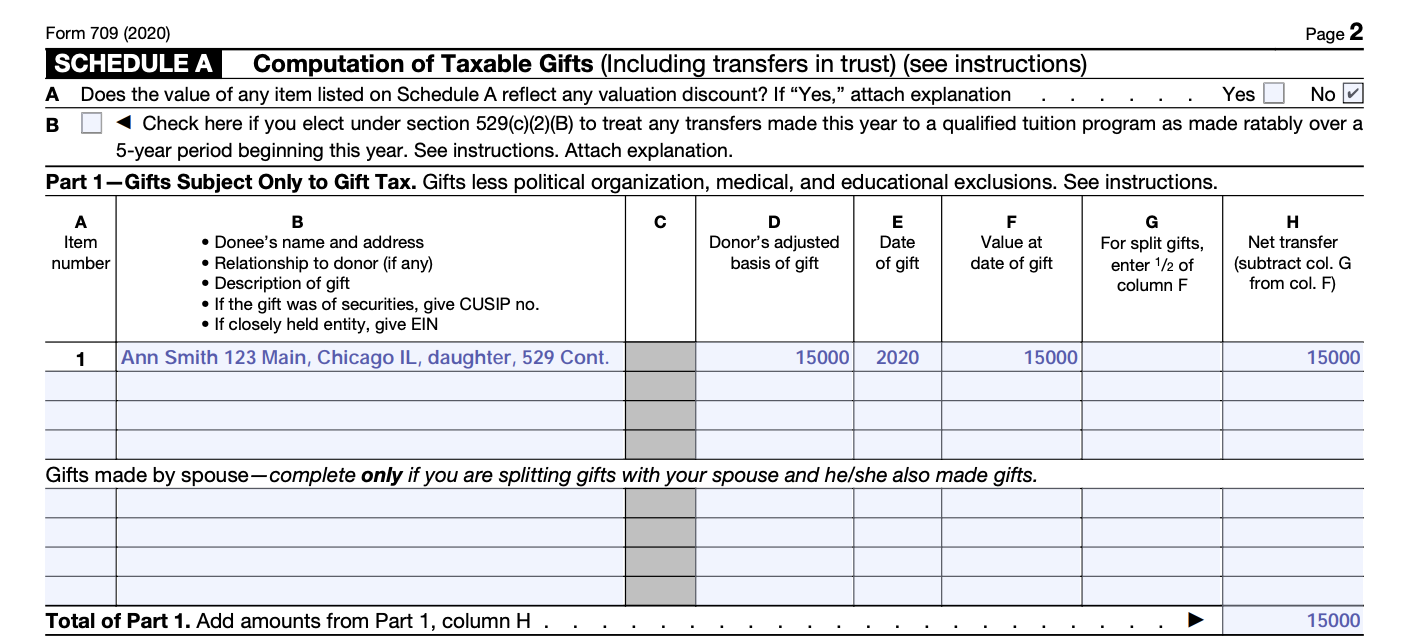

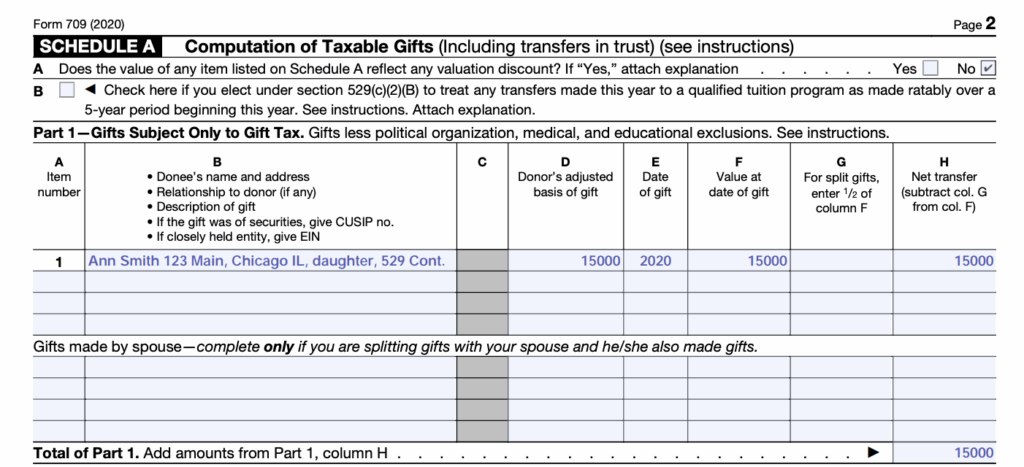

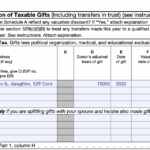

Superfund 529 Plan White Coat Investor