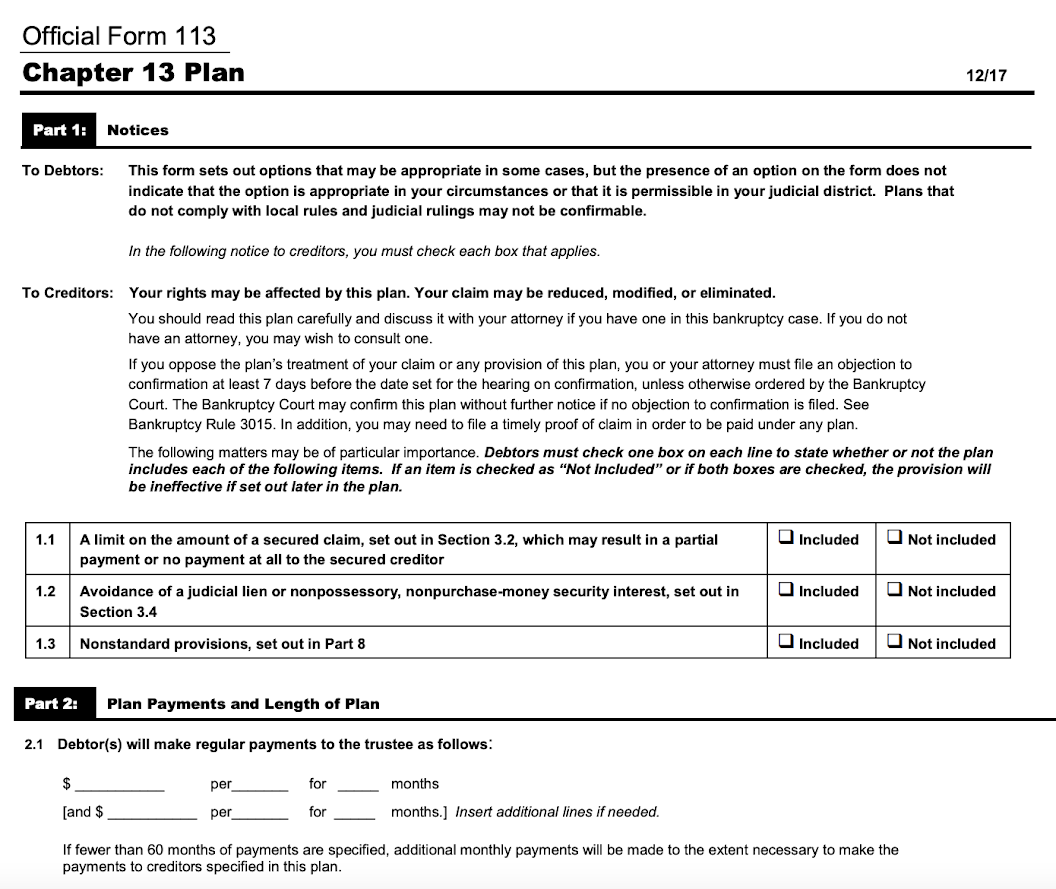

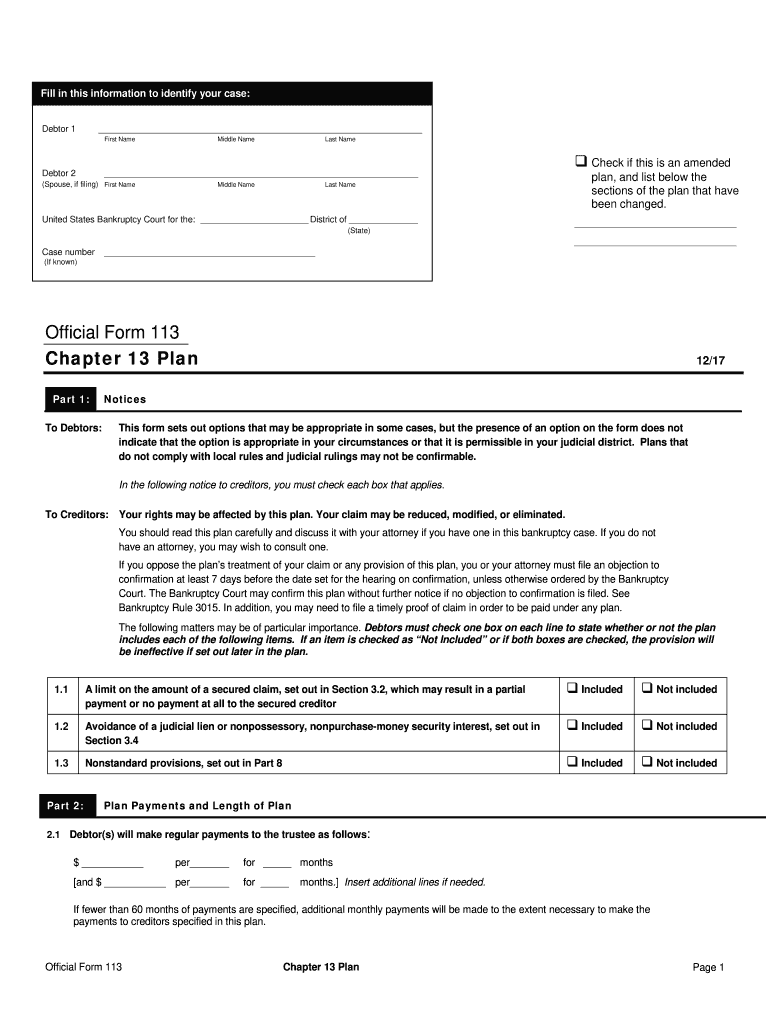

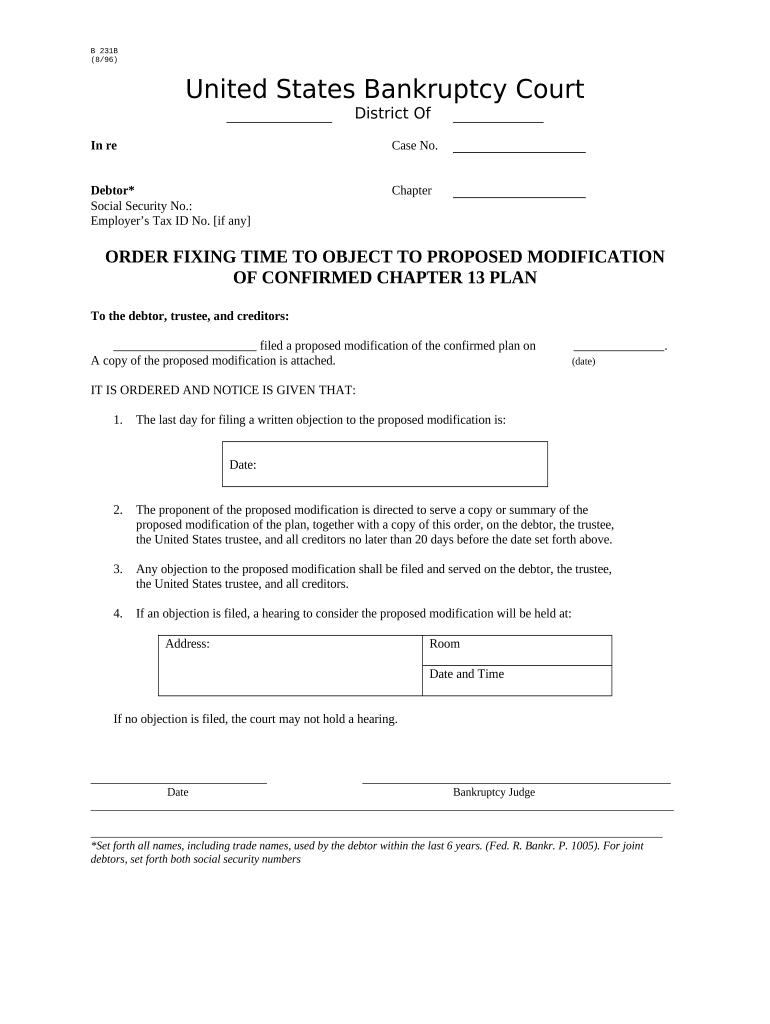

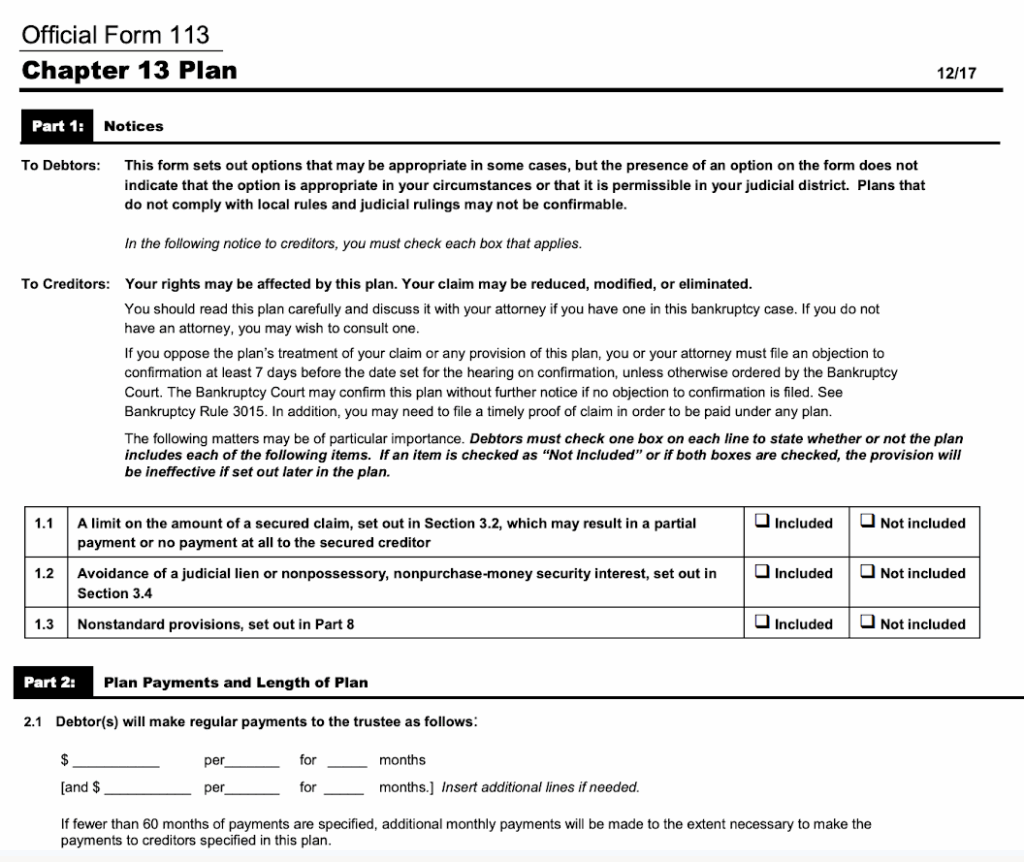

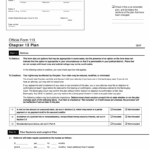

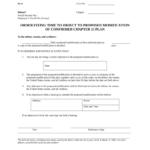

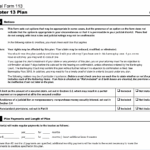

A Chapter 13 Plan Form is a legal document used in bankruptcy proceedings to outline a debtor’s proposed repayment plan to creditors. This form is essential for individuals who are seeking relief from overwhelming debt and wish to reorganize their finances in a manageable way. The Chapter 13 Plan Form typically includes details such as the debtor’s income, expenses, assets, and proposed repayment terms. It serves as a roadmap for how the debtor will repay their debts over a specified period, usually three to five years.

When filling out a Chapter 13 Plan Form, it is crucial to provide accurate and detailed information about your financial situation. Start by listing all sources of income, including wages, bonuses, and any other sources of revenue. Next, outline your monthly expenses, such as rent or mortgage payments, utilities, food, and transportation costs. Be sure to include all debts owed, including credit card balances, medical bills, and any outstanding loans. Finally, propose a repayment plan that is feasible based on your income and expenses. Once completed, the Chapter 13 Plan Form must be submitted to the bankruptcy court for approval.

Chapter 13 Plan Form

Benefits of Using a Chapter 13 Plan Form

One of the primary benefits of using a Chapter 13 Plan Form is that it allows debtors to restructure their debts in a way that is manageable and affordable. By proposing a repayment plan through the Chapter 13 process, debtors can avoid foreclosure, repossession, and other adverse consequences of bankruptcy. Additionally, Chapter 13 allows debtors to retain their assets and possessions while still satisfying their financial obligations. Ultimately, the Chapter 13 Plan Form provides a structured framework for debtors to regain control of their finances and work towards a fresh start.

In conclusion, a Chapter 13 Plan Form is a crucial document for individuals navigating the bankruptcy process. By accurately completing this form and proposing a feasible repayment plan, debtors can reorganize their finances and work towards a debt-free future. If you are considering filing for Chapter 13 bankruptcy, consult with a qualified attorney to ensure that your Chapter 13 Plan Form is properly prepared and submitted for approval.

Download Chapter 13 Plan Form

Chapter 13 Forms PDF Pre built Template AirSlate SignNow

The Bankruptcy Help Blog Post