The Canada Revenue Agency (CRA) Lifelong Learning Plan (LLP) is a program that allows you to withdraw funds from your Registered Retirement Savings Plan (RRSP) to finance your education or training. This plan is designed to help individuals further their education without incurring additional debt.

To take advantage of the CRA LLP, you must meet certain criteria, such as being a Canadian resident, having an RRSP account, and enrolling in a qualifying educational program. The funds withdrawn must be repaid within a specified period to avoid tax penalties.

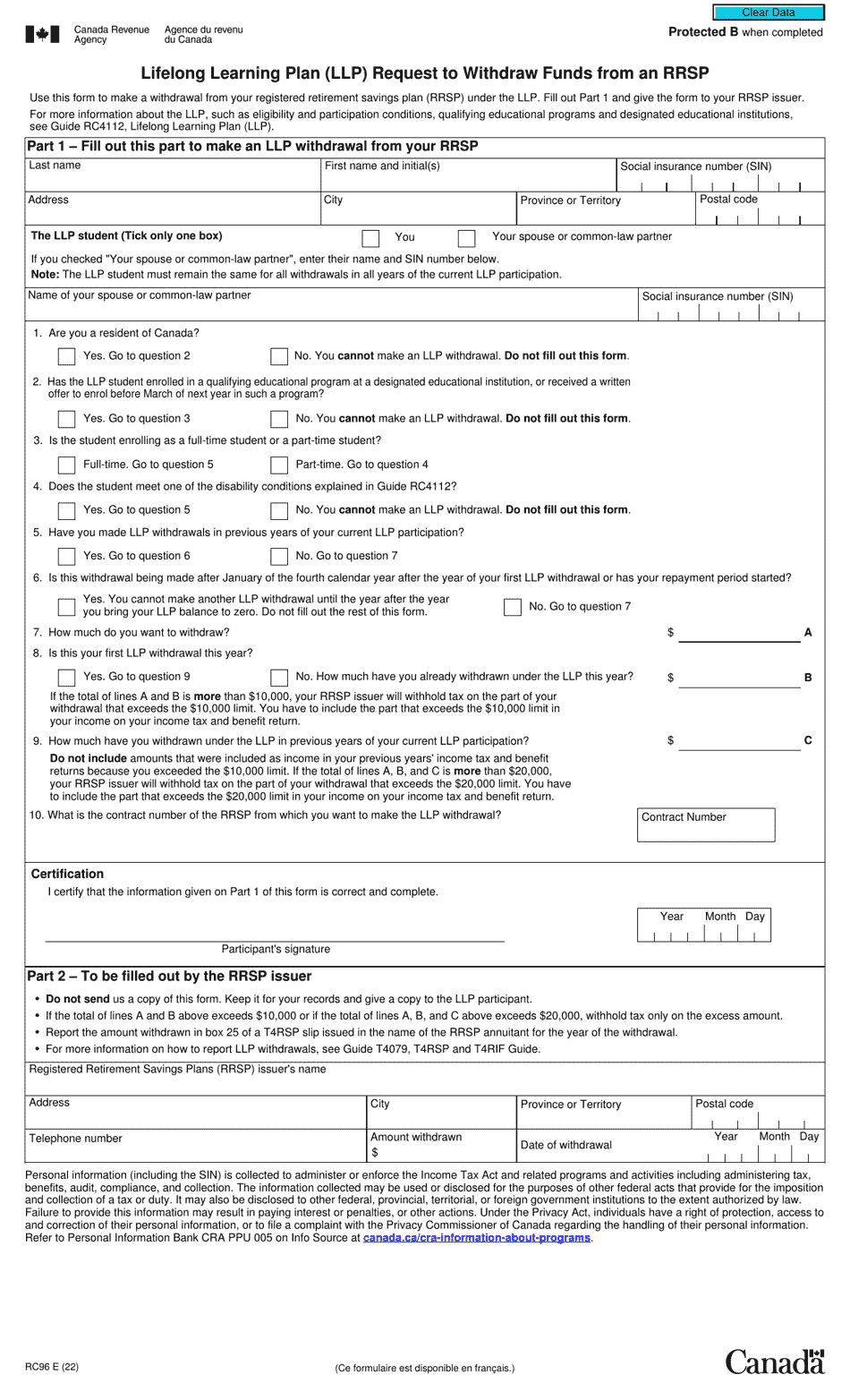

Cra Lifelong Learning Plan Form

How to Access the CRA Lifelong Learning Plan Form

To access the CRA Lifelong Learning Plan form, you can visit the CRA website or contact your financial institution that holds your RRSP account. The form will require you to provide information about your RRSP account, the educational program you plan to enroll in, and the amount you wish to withdraw.

Once you have completed the form, you must submit it to the CRA for approval. If your application is approved, you can withdraw the funds from your RRSP account to finance your education. Remember that the funds must be repaid within the specified timeframe to avoid tax implications.

Benefits of the CRA Lifelong Learning Plan

By utilizing the CRA Lifelong Learning Plan, you can access funds from your RRSP to invest in your education and future career prospects. This can help you avoid taking on additional student loans or debt to further your education. Additionally, repayments made back into your RRSP are not considered new contributions and do not affect your annual contribution limit.

Overall, the CRA Lifelong Learning Plan is a valuable tool for individuals looking to invest in their education and career development while minimizing financial burdens. By understanding the process and requirements of the plan, you can make informed decisions about how to best utilize this educational funding option.