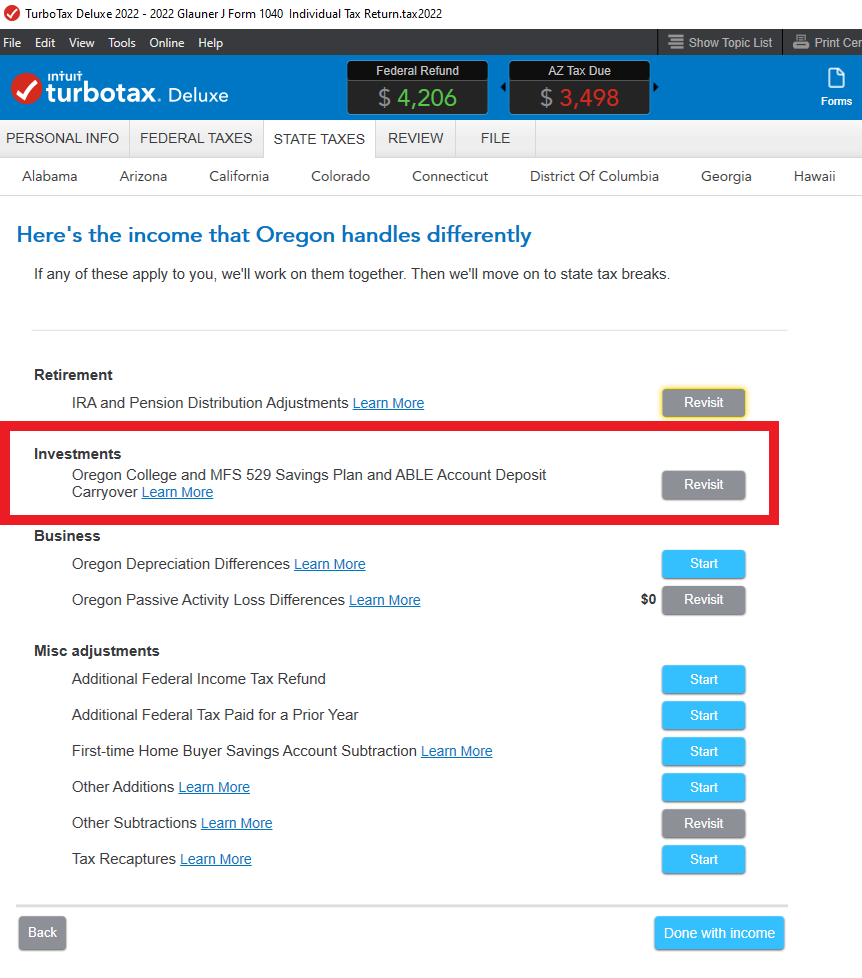

When it comes to saving for your child’s education, the Oregon College Savings Plan is a popular choice for many families. One important aspect of managing your college savings account is understanding the tax implications. Each year, you may receive tax forms related to your Oregon College Savings Plan contributions and withdrawals.

Form 1099-Q is a tax form that reports distributions from a 529 plan, such as the Oregon College Savings Plan. If you made withdrawals from your college savings account during the tax year, you will receive this form. It is important to include this information on your federal tax return to accurately report any taxable income associated with the withdrawals.

Oregon College Savings Plan Tax Forms

Form 1099-Q will provide details on the total amount of withdrawals made during the tax year, as well as the portion of the withdrawal that represents earnings. It is essential to review this form carefully and consult with a tax professional if you have any questions about how to report these distributions on your tax return.

Completing Form 1099-Q

When you receive Form 1099-Q, you will need to transfer the information from the form to your federal tax return. The earnings portion of the withdrawal is subject to income tax and may be subject to an additional 10% penalty if not used for qualified education expenses. Be sure to accurately report this information on your tax return to avoid any potential penalties or audits.

Keep in mind that contributions to the Oregon College Savings Plan are not tax-deductible on your federal tax return, but earnings grow tax-free as long as they are used for qualified education expenses. By understanding and properly reporting your Oregon College Savings Plan tax forms, you can make the most of your college savings account and ensure compliance with IRS regulations.