An Allocated Spending Plan Form is a tool that helps individuals or households track their income and expenses to create a budget that allocates specific amounts of money to different categories, such as housing, transportation, groceries, entertainment, and savings. This form is essential for managing finances effectively and reaching financial goals.

By using an Allocated Spending Plan Form, individuals can see where their money is going each month and make adjustments to ensure they are not overspending in any category. This form can also help identify areas where expenses can be reduced or eliminated to free up more money for savings or debt repayment.

Allocated Spending Plan Form

How to Use an Allocated Spending Plan Form

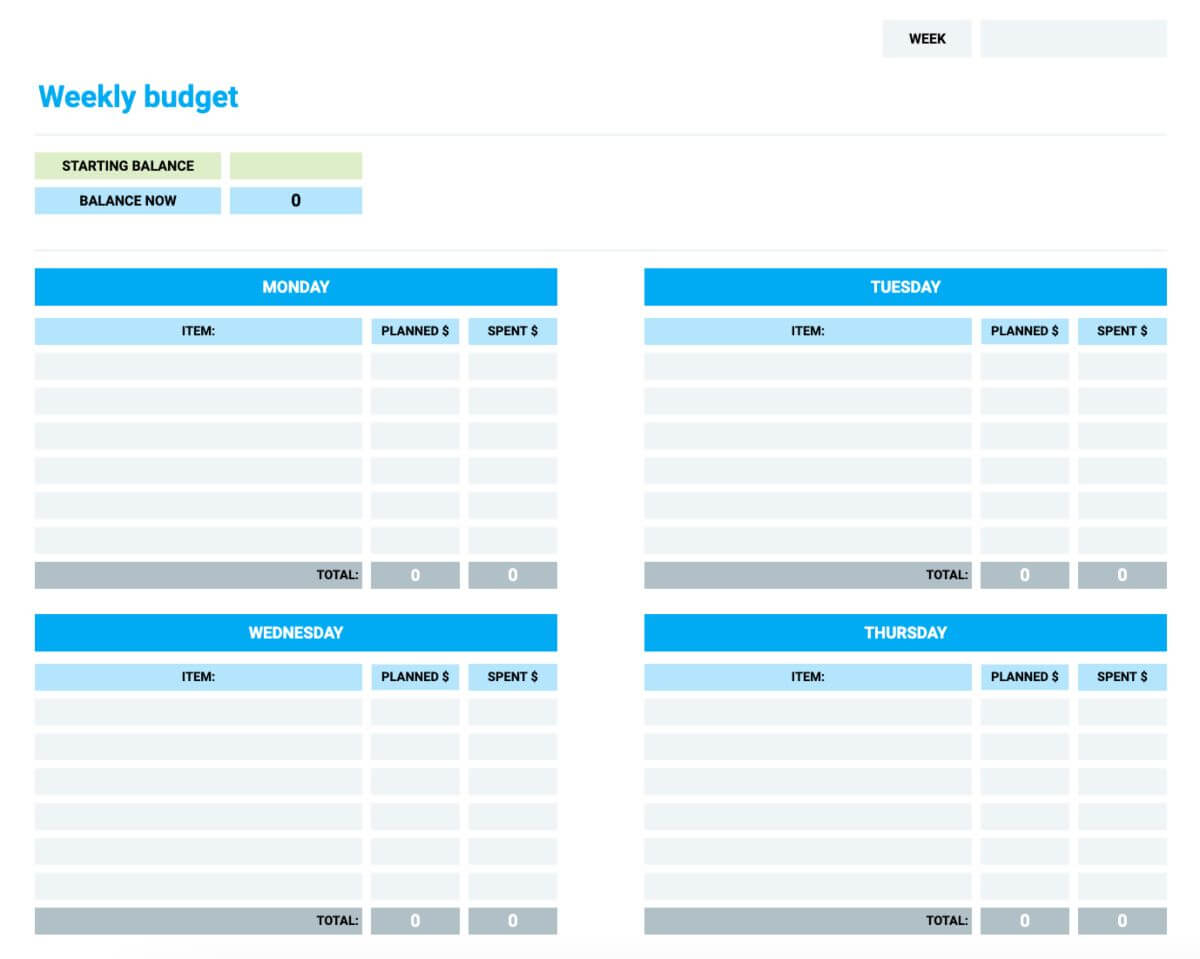

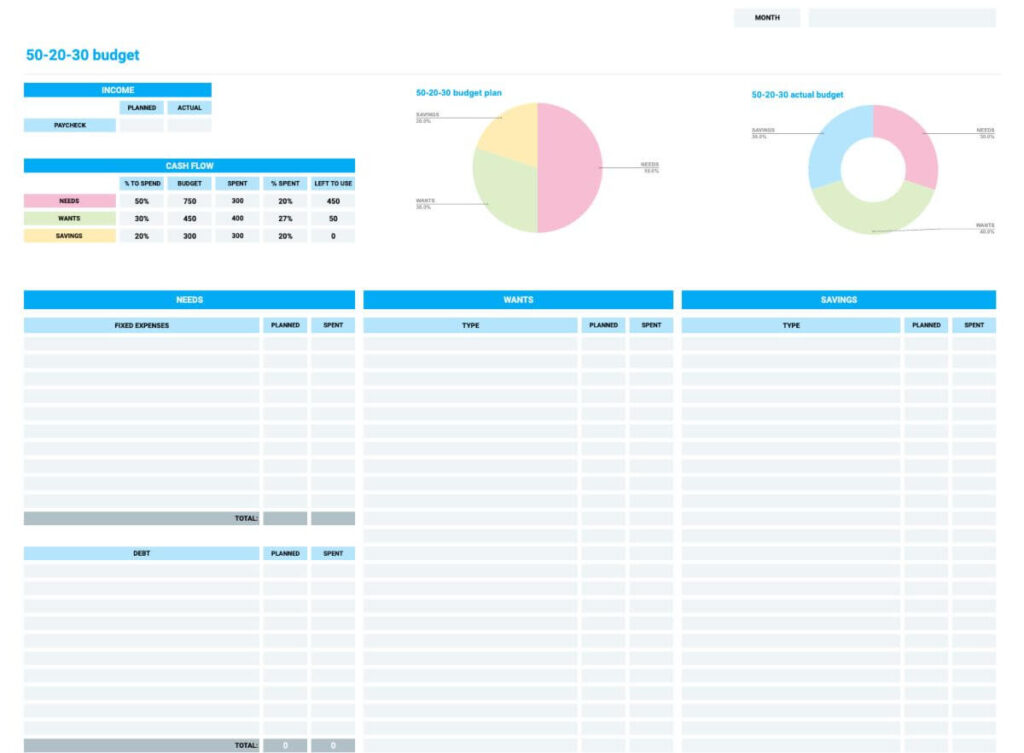

Using an Allocated Spending Plan Form is simple and straightforward. Start by listing all sources of income, such as salaries, bonuses, or side hustles. Next, list all fixed expenses, such as rent or mortgage payments, utilities, and insurance premiums. Then, allocate specific amounts of money to variable expenses, such as groceries, dining out, entertainment, and transportation.

Once all income and expenses are listed, subtract total expenses from total income to determine if there is a surplus or deficit. If there is a surplus, consider allocating more money to savings or investments. If there is a deficit, look for areas where expenses can be reduced or eliminated to balance the budget.

Benefits of Using an Allocated Spending Plan Form

There are several benefits to using an Allocated Spending Plan Form. Firstly, it helps individuals gain a better understanding of their financial situation and make informed decisions about their money. Secondly, it can help individuals prioritize their spending and focus on what matters most to them. Lastly, it can help individuals track their progress towards financial goals and make adjustments as needed.

Overall, an Allocated Spending Plan Form is a valuable tool for anyone looking to take control of their finances and improve their financial well-being. By using this form regularly, individuals can make smarter financial decisions, reduce financial stress, and work towards achieving their long-term financial goals.