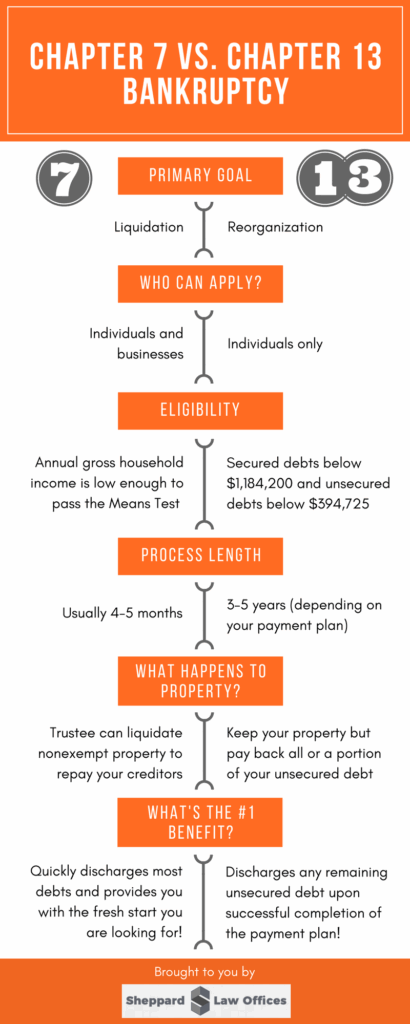

A Chapter 13 bankruptcy allows individuals with a regular income to develop a plan to repay all or part of their debts. In Ohio, a Chapter 13 plan form is a legal document that outlines the debtor’s proposed repayment plan to the bankruptcy court. This form is crucial in determining how much the debtor will pay, how long the repayment period will last, and the treatment of each creditor’s claim.

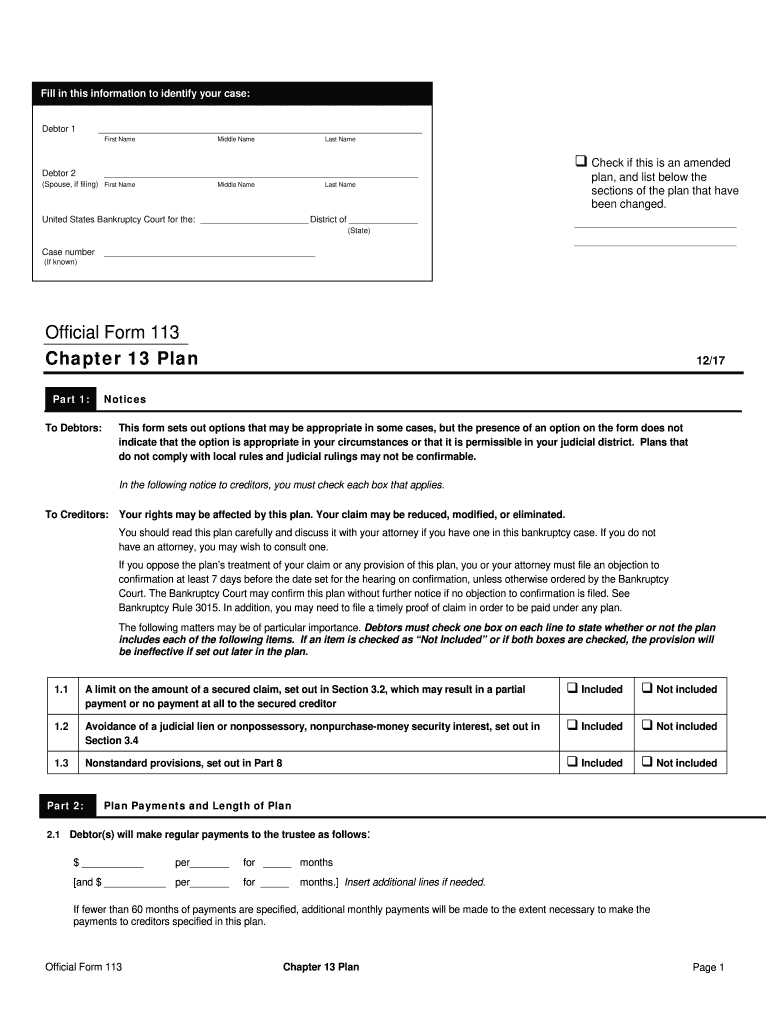

When filling out a Chapter 13 plan form in Ohio, debtors must provide detailed information about their income, expenses, assets, and debts. This information helps the court assess the debtor’s financial situation and determine the feasibility of the repayment plan. The debtor’s proposed plan must comply with the requirements of the Bankruptcy Code and meet the approval of the bankruptcy trustee and creditors.

Chapter 13 Plan Form Ohio

How to Fill Out a Chapter 13 Plan Form in Ohio

When filling out a Chapter 13 plan form in Ohio, debtors should consult with an experienced bankruptcy attorney to ensure that all required information is accurately provided. The form typically includes sections for the debtor’s personal information, income, expenses, assets, debts, and proposed repayment plan. Debtors must also calculate their disposable income and determine how much they can afford to pay each month towards their debts.

After completing the Chapter 13 plan form, debtors must file it with the bankruptcy court and serve a copy on all creditors. The court will schedule a confirmation hearing where the judge will review the plan, hear objections from creditors, and decide whether to approve or modify the proposed repayment plan. Once the plan is confirmed, debtors must make regular payments to the trustee according to the terms of the plan until all debts are repaid.

Benefits of Filing a Chapter 13 Plan Form in Ohio

One of the main benefits of filing a Chapter 13 plan form in Ohio is that it allows debtors to restructure their debts and repay them over a period of three to five years. This can help debtors avoid foreclosure, repossession, or wage garnishment and regain control of their finances. Additionally, Chapter 13 bankruptcy can help debtors protect their assets from liquidation and discharge certain types of debts, such as credit card bills, medical bills, and personal loans.

By successfully completing a Chapter 13 repayment plan, debtors can achieve a fresh financial start and rebuild their credit over time. It is essential for debtors to comply with the terms of the plan and make timely payments to the trustee to successfully complete the bankruptcy process. Consulting with a knowledgeable bankruptcy attorney can help debtors navigate the Chapter 13 bankruptcy process and maximize the benefits of filing a Chapter 13 plan form in Ohio.

In conclusion, filling out a Chapter 13 plan form in Ohio is a critical step in the Chapter 13 bankruptcy process. By providing accurate information and proposing a feasible repayment plan, debtors can achieve financial relief and a fresh start. Consulting with a bankruptcy attorney can help debtors navigate the complex bankruptcy laws and maximize the benefits of filing a Chapter 13 plan form in Ohio.

Download Chapter 13 Plan Form Ohio

Free Ohio Custody Parenting Plan Agreement PDF EForms

2017 2025 Official Form 113 Fill Online Printable Fillable Blank PdfFiller