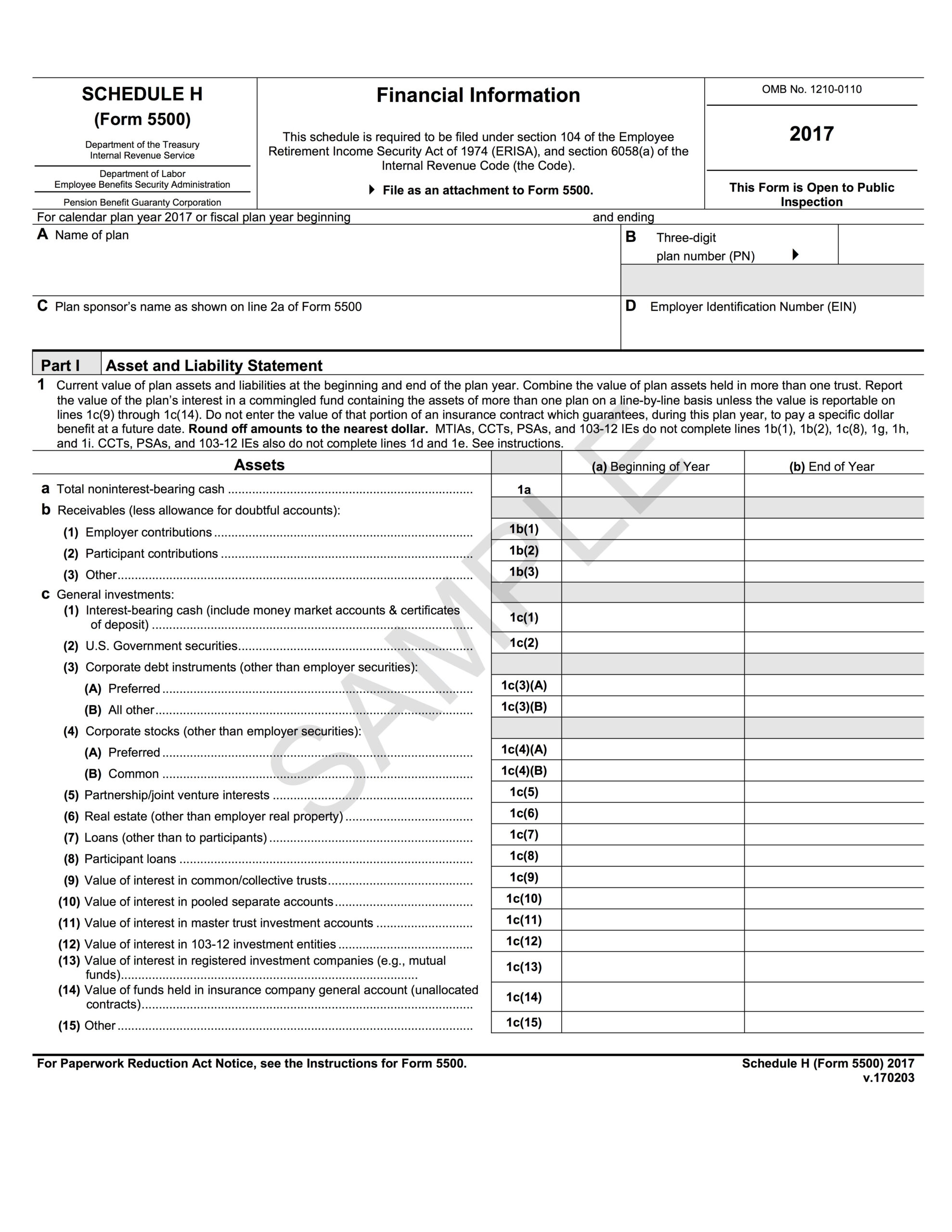

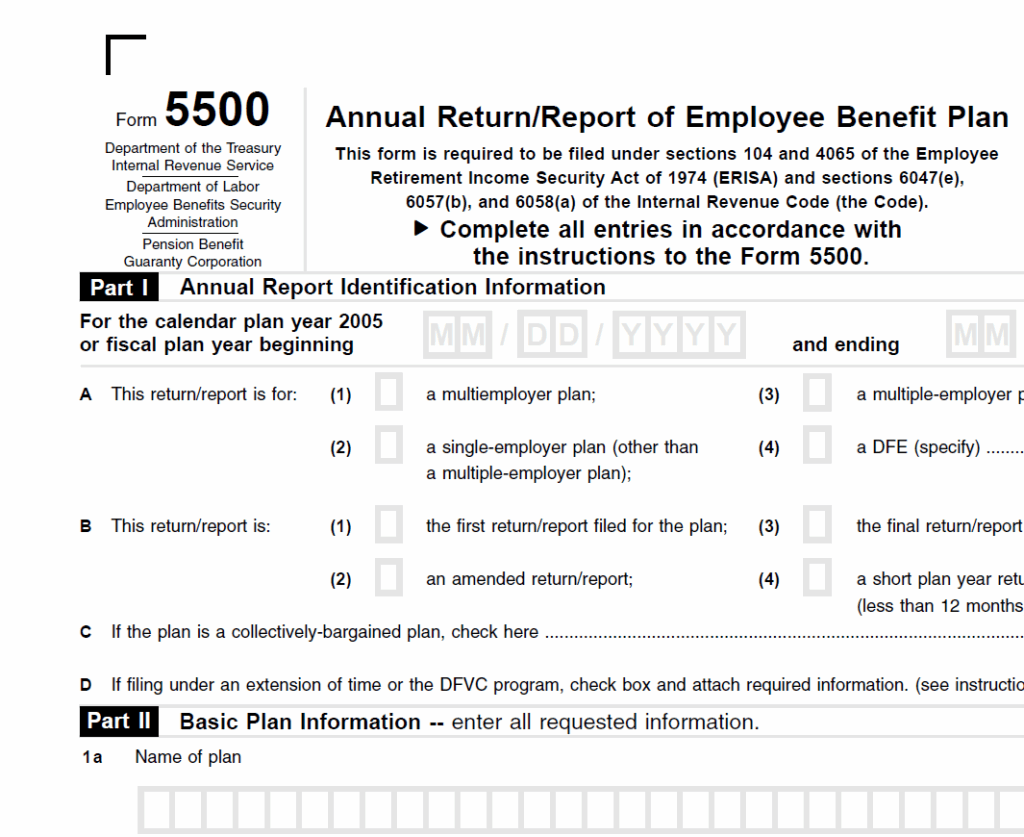

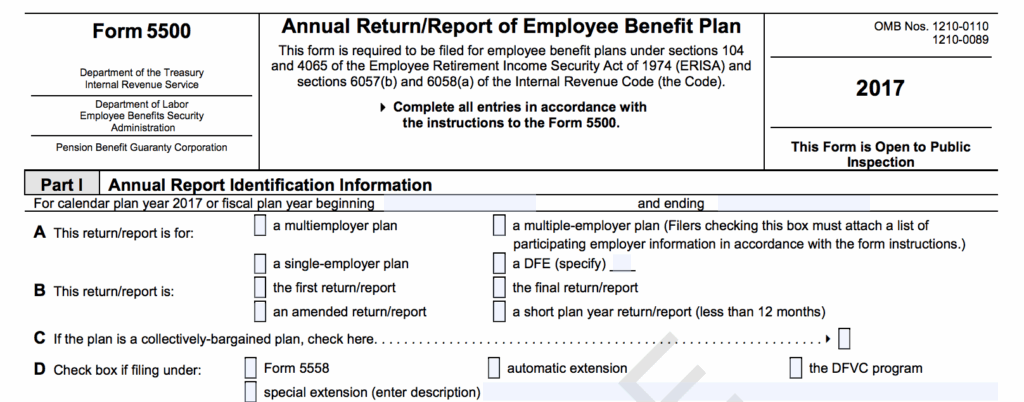

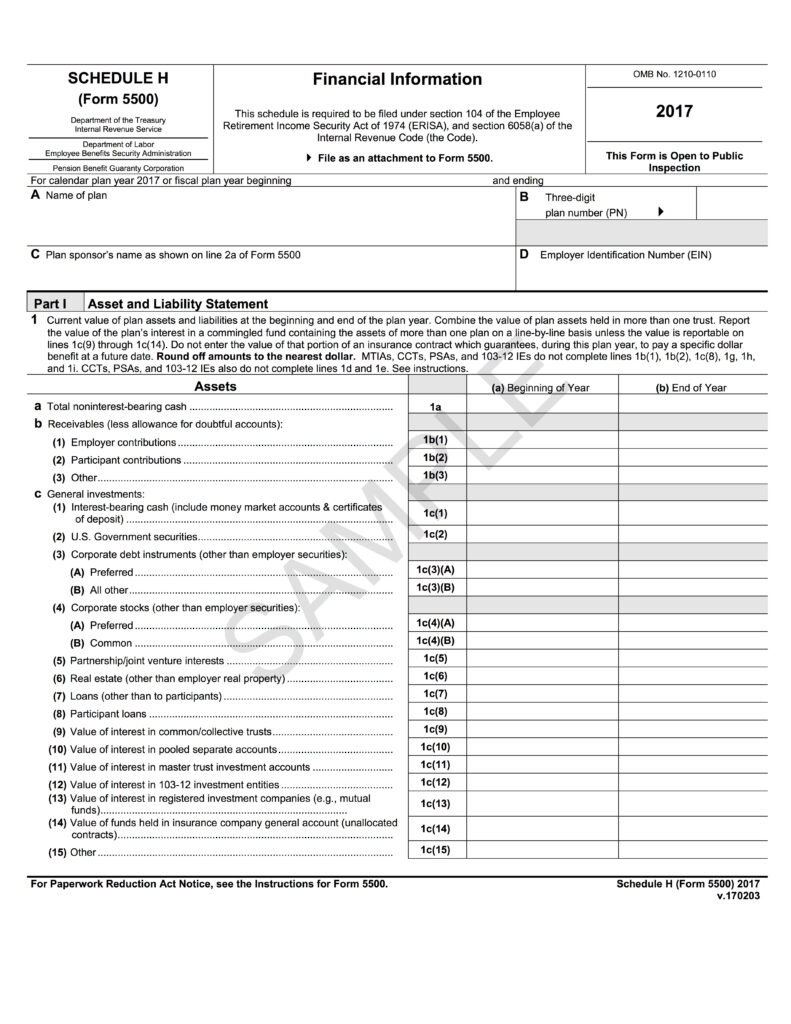

Governmental plans, such as those offered by state and local governments, are subject to specific reporting requirements under the Employee Retirement Income Security Act (ERISA). One of the key forms that must be filed annually by governmental plans is the Form 5500. This form is used to provide information about the plan’s financial condition, investments, and operations to the Department of Labor, the Internal Revenue Service, and the Pension Benefit Guaranty Corporation.

Form 5500 is a comprehensive reporting document that must be completed by the administrator of a governmental plan. The form requires detailed information about the plan, including the number of participants, contributions and distributions, investments, and other financial data. The purpose of Form 5500 is to ensure transparency and accountability in the management of retirement plans and to provide regulators with the necessary information to oversee compliance with ERISA regulations.

Form 5500 Governmental Plan

Filing Requirements for Governmental Plans

Governmental plans are required to file Form 5500 if they cover 100 or more participants at the beginning of the plan year. In some cases, plans with fewer than 100 participants may also be required to file, depending on the plan’s funding status and other factors. The filing deadline for Form 5500 is the last day of the seventh month after the end of the plan year, with the option to request an extension if needed. Failure to file Form 5500 can result in penalties and sanctions imposed by regulatory agencies.

Conclusion

Understanding and complying with the filing requirements for Form 5500 is essential for governmental plans to ensure that they are meeting their obligations under ERISA. By providing accurate and timely information through Form 5500, plan administrators can demonstrate their commitment to transparency and accountability in managing retirement benefits for their employees. Working with legal and financial advisors can help governmental plans navigate the complexities of Form 5500 reporting and ensure compliance with ERISA regulations.

By following these guidelines, you can create a well-structured and informative article that is optimized for search engines and provides valuable information to readers interested in Form 5500 for governmental plans.

Download Form 5500 Governmental Plan

Form 5500 Instructions 5 Steps To Filing Correctly ForUsAll Blog

Form 5500 Instructions 5 Steps To Filing Correctly ForUsAll Blog