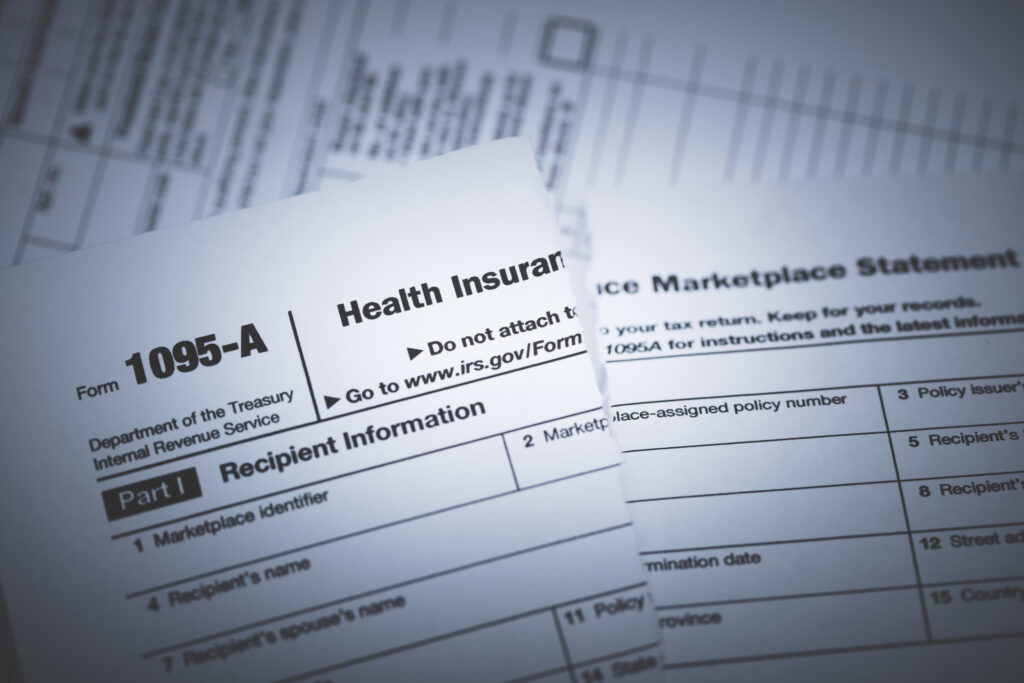

As a participant in the Healthy Indiana Plan (HIP), it is crucial to understand the tax implications of your healthcare coverage. One key aspect of maintaining your eligibility for HIP is to accurately report your income and file the necessary tax forms each year. The Healthy Indiana Plan Tax Form, also known as Form 1095-B, provides proof of your healthcare coverage and is essential for fulfilling your tax obligations.

By filing your Healthy Indiana Plan Tax Form, you not only comply with federal tax requirements but also ensure that you continue to receive the benefits of your healthcare coverage. Failure to report your HIP coverage on your tax return could result in penalties or even loss of eligibility for the program. Therefore, it is vital to stay informed and up-to-date on the tax responsibilities associated with your HIP enrollment.

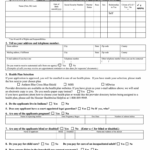

Healthy Indiana Plan Tax Form

How to Obtain Your Healthy Indiana Plan Tax Form

Obtaining your Healthy Indiana Plan Tax Form is a straightforward process. Each year, the Indiana Family and Social Services Administration (FSSA) will mail Form 1095-B to the address they have on file for you. This form will outline the months in which you were enrolled in the Healthy Indiana Plan and provide proof of your healthcare coverage for tax purposes.

If you have not received your Healthy Indiana Plan Tax Form or need a duplicate copy, you can contact the FSSA or log in to your HIP member account online. It is essential to keep a copy of your Form 1095-B for your records and to include it when filing your taxes to avoid any discrepancies or issues with your healthcare coverage.

Tips for Completing Your Healthy Indiana Plan Tax Form

When completing your Healthy Indiana Plan Tax Form, ensure that all information is accurate and up-to-date. Double-check your personal details, including your name, address, and Social Security number, to avoid any errors that could delay the processing of your tax return. Additionally, review the months of coverage listed on Form 1095-B to confirm that it aligns with your records of enrollment in the Healthy Indiana Plan.

If you have any questions or concerns about your Healthy Indiana Plan Tax Form, do not hesitate to reach out to the FSSA for assistance. They can provide guidance on how to correctly fill out the form and address any issues that may arise during the tax filing process. By taking the time to complete your Form 1095-B accurately, you can ensure that you remain in compliance with HIP requirements and maintain your healthcare coverage throughout the year.

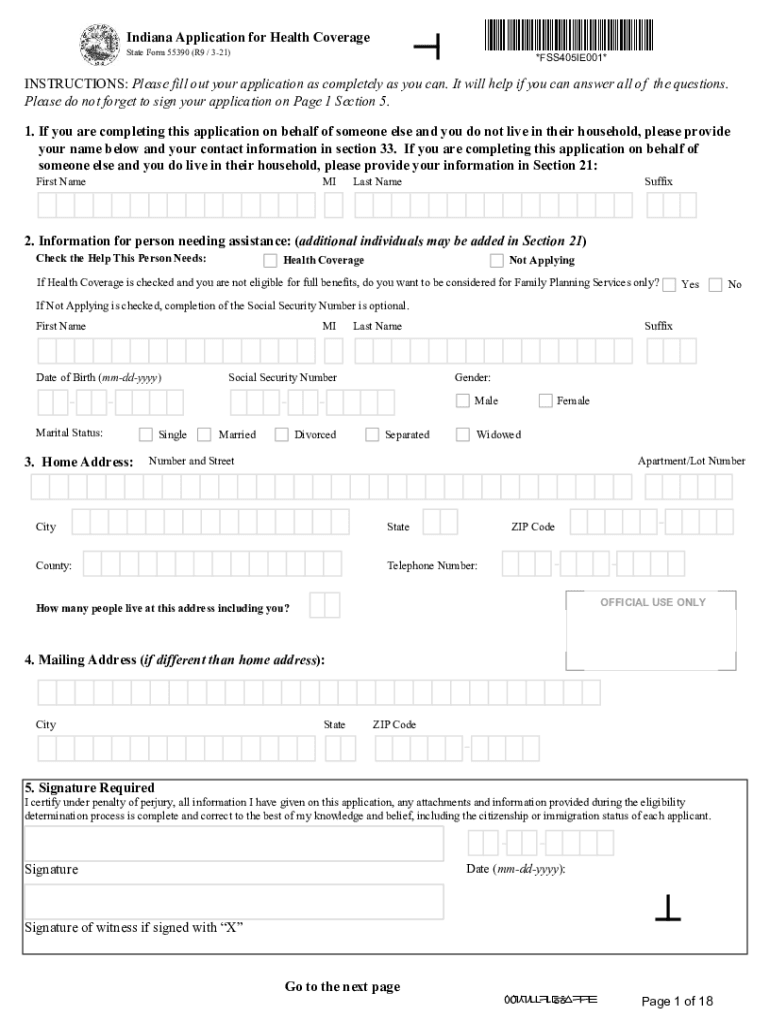

Download Healthy Indiana Plan Tax Form

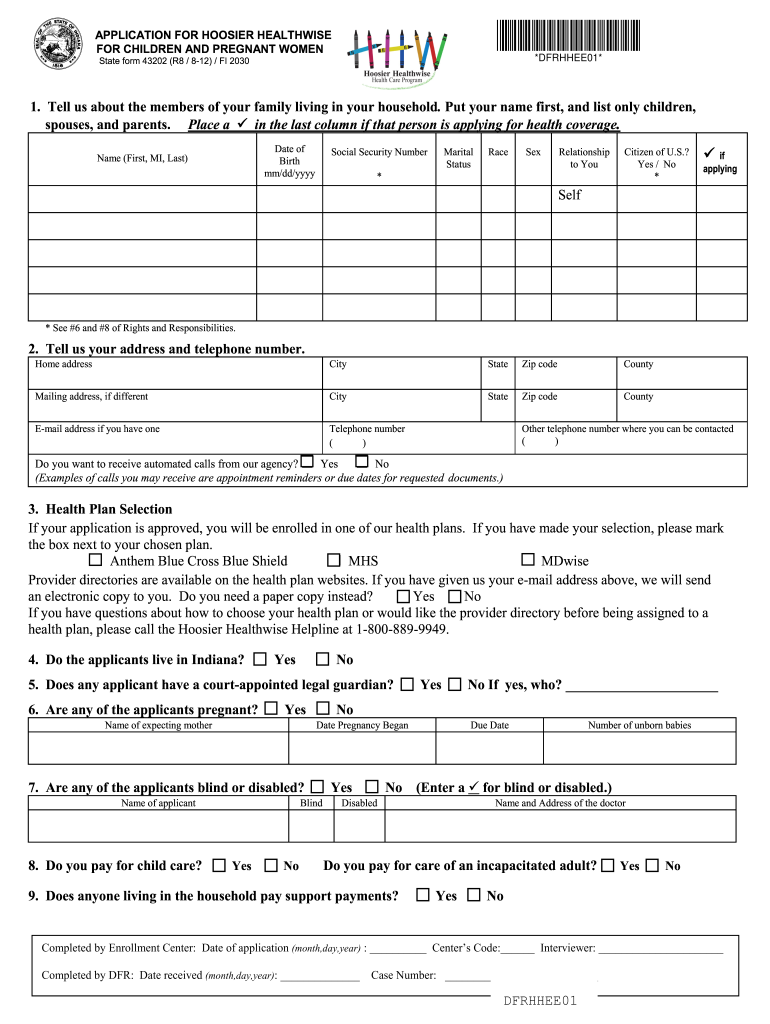

Fssa Fax Number Fill Out Sign Online DocHub

Indiana Hoosier Health Card Fill Out Sign Online DocHub