Home Buyer Plan Withdrawal Form

**Title: Everything You Need to Know About the Home Buyer Plan Withdrawal Form**

**Introduction:**

If you’re considering withdrawing funds from your Home Buyer Plan (HBP) to purchase your first home, it’s essential to understand the process and requirements involved. One crucial aspect of this process is the Home Buyer Plan Withdrawal Form, which is necessary to access your HBP funds. In this article, we’ll provide you with all the information you need to know about the Home Buyer Plan Withdrawal Form and how to complete it correctly.

**Completing the Home Buyer Plan Withdrawal Form**

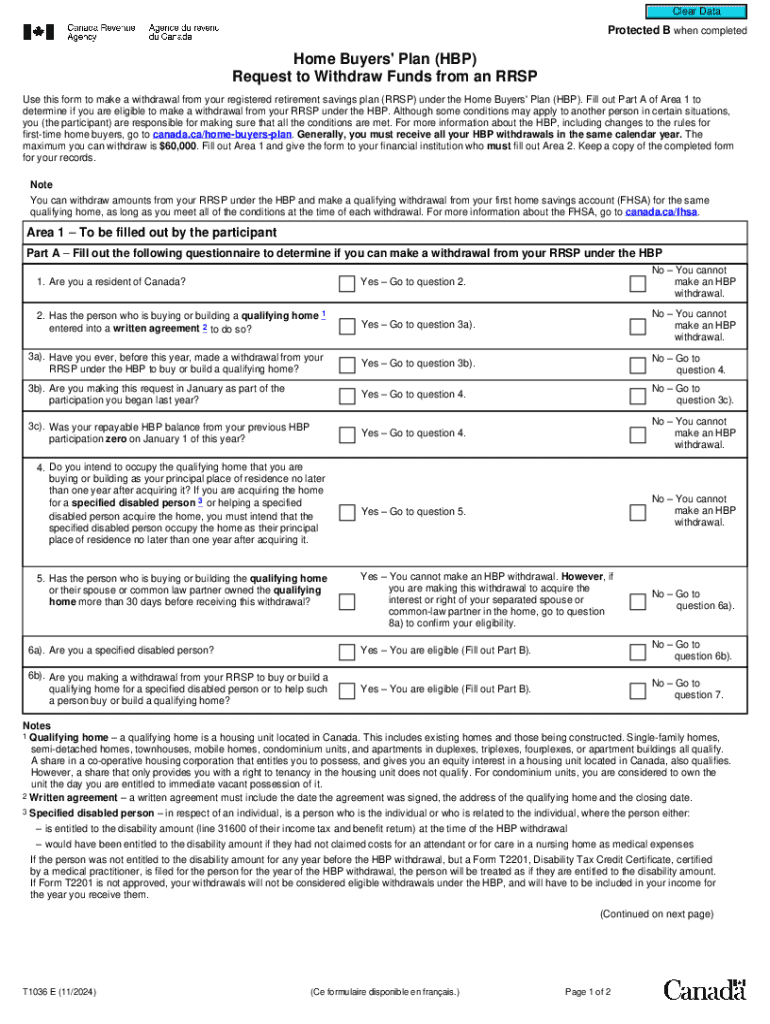

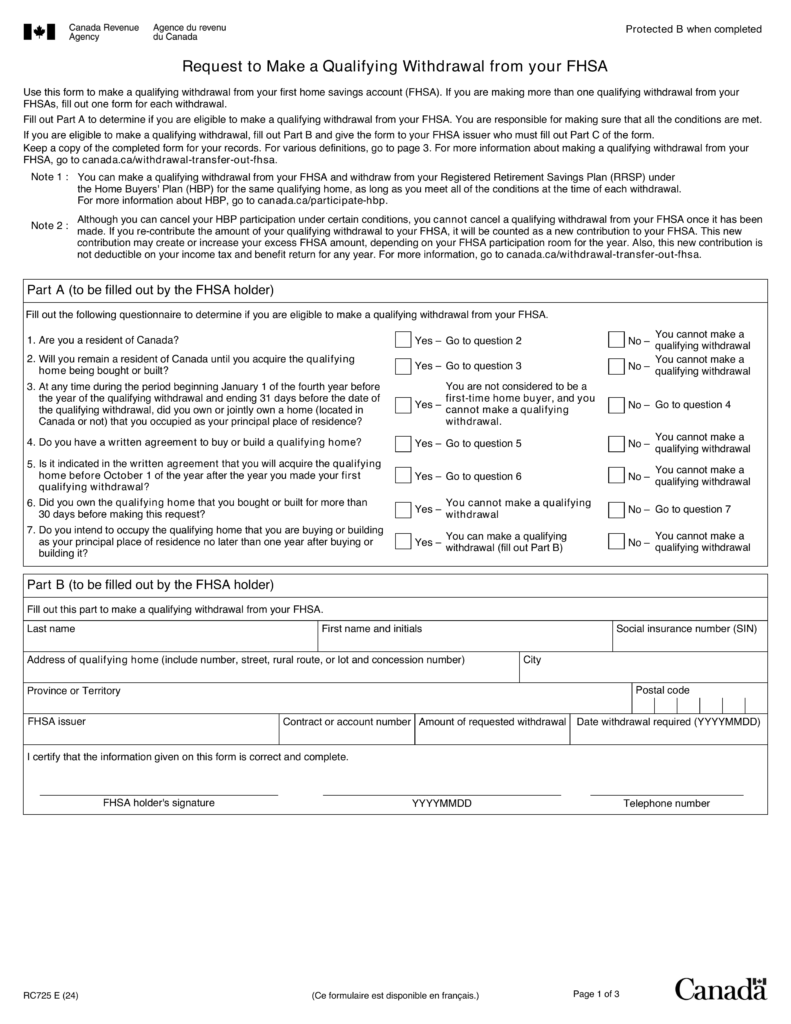

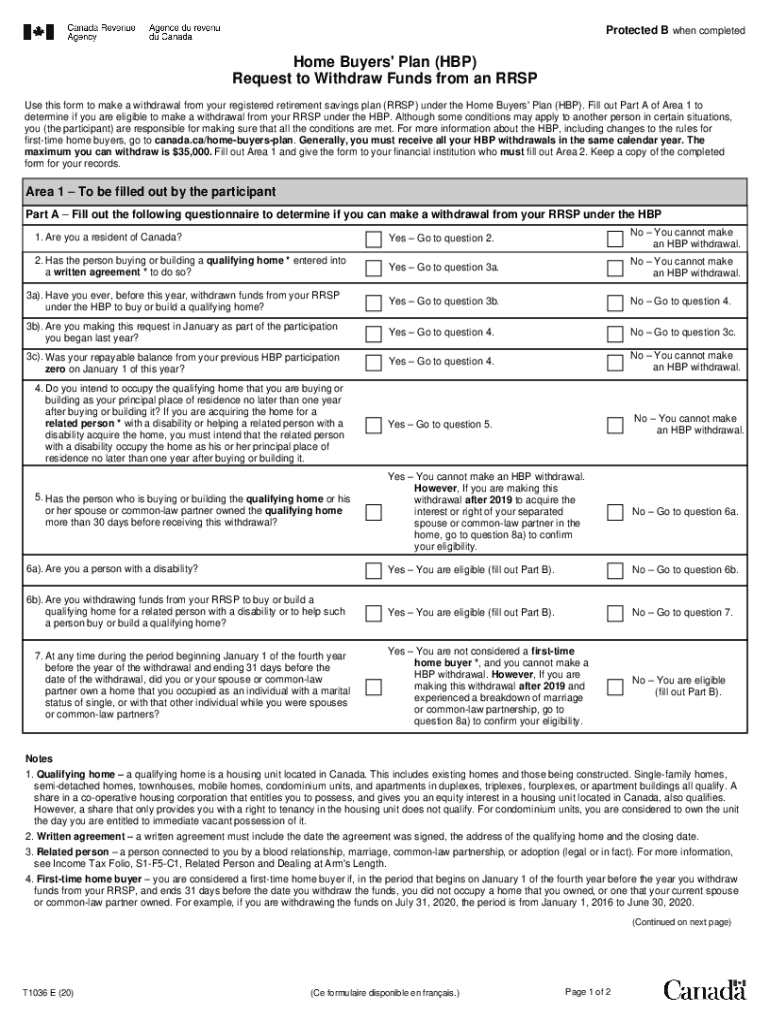

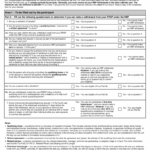

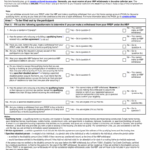

To withdraw funds from your HBP, you’ll need to fill out the Home Buyer Plan Withdrawal Form, also known as Form T1036. This form is provided by the Canada Revenue Agency (CRA) and must be completed accurately to avoid any delays or complications in accessing your HBP funds.

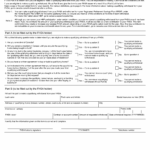

When completing the Home Buyer Plan Withdrawal Form, you’ll need to provide information such as your name, social insurance number, the amount you wish to withdraw, and the details of your qualifying home purchase. It’s crucial to ensure that all the information you provide is accurate and up-to-date to avoid any issues with your HBP withdrawal.

Once you’ve completed the Home Buyer Plan Withdrawal Form, you’ll need to submit it to your financial institution, along with any other required documentation. Your financial institution will then process your withdrawal request and disburse the funds to you for use towards your qualifying home purchase.

**Important Considerations When Withdrawing HBP Funds**

Before completing the Home Buyer Plan Withdrawal Form, there are a few essential considerations to keep in mind. Firstly, the maximum amount you can withdraw from your HBP is $35,000, or $70,000 for a couple, which must be repaid within a 15-year period. Additionally, you must be considered a first-time homebuyer to be eligible for the HBP, and the home you’re purchasing must be your primary residence.

It’s also crucial to note that failing to repay the withdrawn amount within the required timeframe will result in penalties and taxes being applied to the outstanding balance. Therefore, it’s essential to carefully consider your repayment plan before withdrawing funds from your HBP to avoid any financial consequences down the line.

In conclusion, the Home Buyer Plan Withdrawal Form is a crucial document that you’ll need to complete to access your HBP funds for a qualifying home purchase. By understanding the requirements and process involved in completing this form correctly, you can ensure a smooth and hassle-free withdrawal of funds to help you achieve your dream of homeownership.

Download Home Buyer Plan Withdrawal Form

T1036 Form Fill Out Sign Online DocHub

2024 Form Canada T1036 E Fill Online Printable Fillable Blank PdfFiller