A 529 plan is a tax-advantaged savings plan designed to help families save for future education expenses. In Illinois, the Bright Start 529 Plan is a popular option for residents looking to save for their children’s college education. By investing in a 529 plan, you can benefit from tax-free growth on your investments and tax-free withdrawals when used for qualified education expenses.

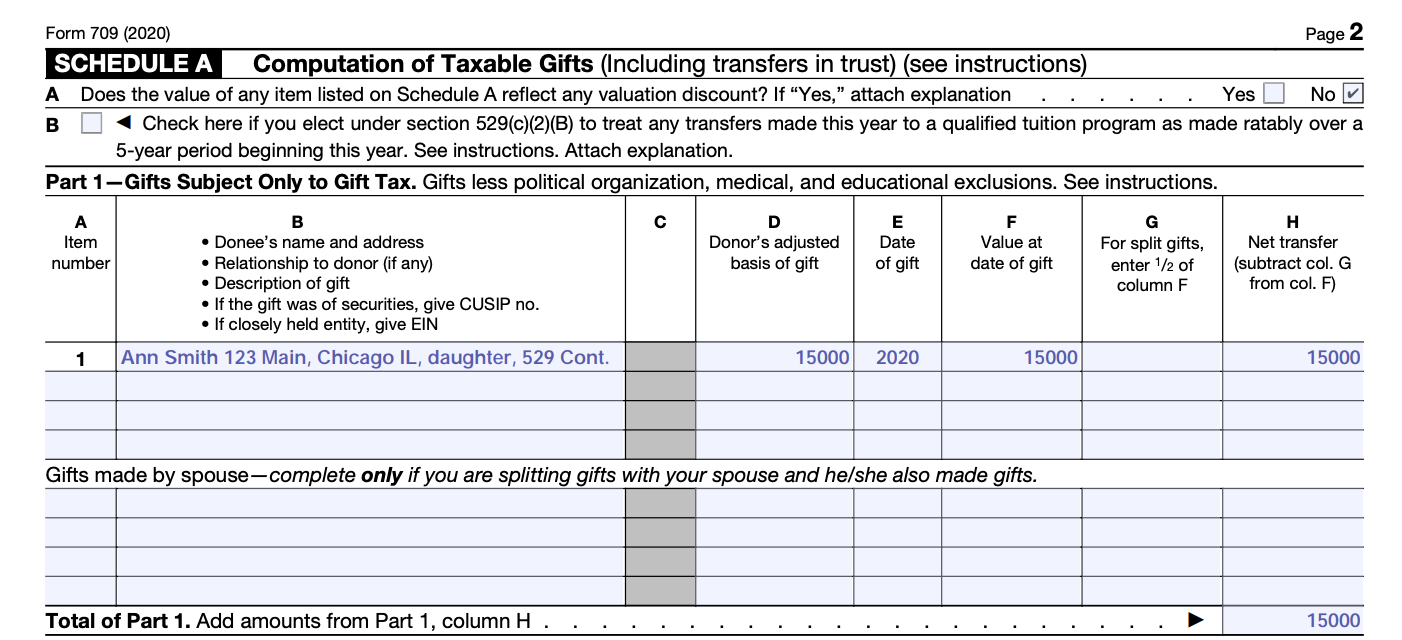

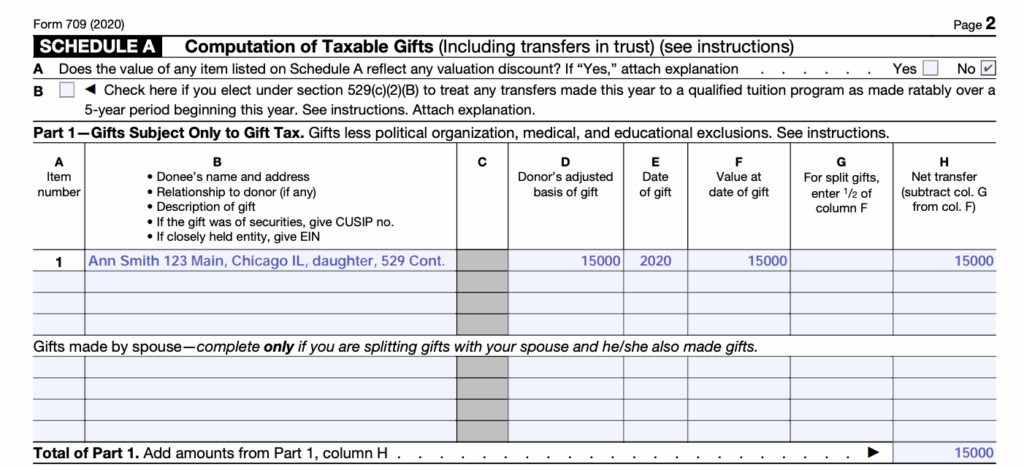

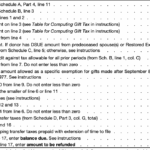

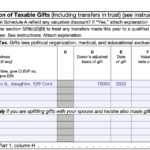

One important aspect of opening a 529 plan is filling out the necessary forms. The Illinois Form for 529 Plan is a key document that you need to complete to open and manage your account. This form collects important information about the account owner, beneficiary, and investment options chosen.

Illinois Form For 529 Plan

How to Fill Out the Illinois Form for 529 Plan

When filling out the Illinois Form for 529 Plan, you will need to provide personal information such as your name, address, social security number, and date of birth. You will also need to designate a beneficiary for the account, typically a child or grandchild, who will use the funds for education expenses in the future.

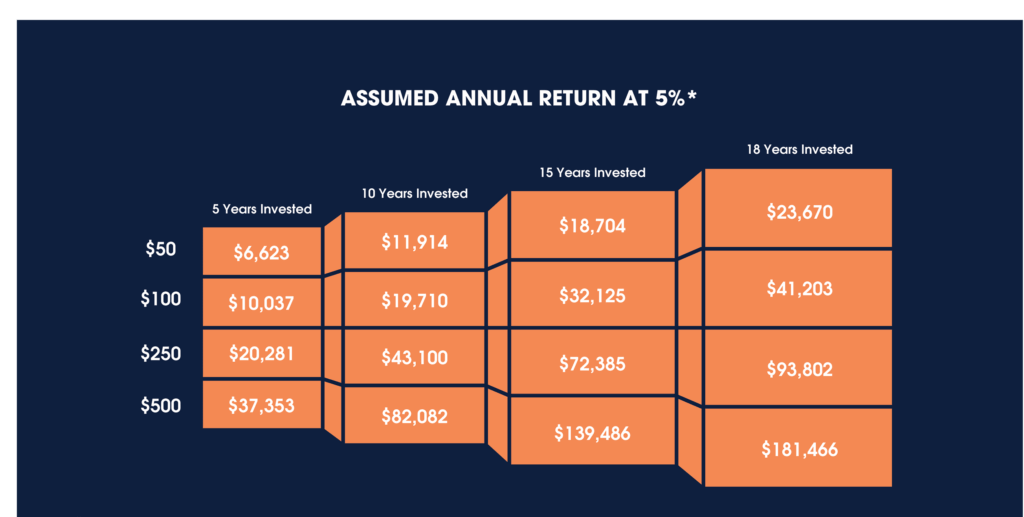

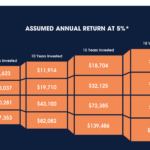

Additionally, the form will ask you to choose an investment option for your contributions. Illinois offers a variety of investment options ranging from conservative to aggressive, allowing you to tailor your investment strategy to your risk tolerance and time horizon. Once you have completed the form and chosen your investment options, you can start contributing to your 529 plan and watch your savings grow over time.

Benefits of Using the Illinois Form for 529 Plan

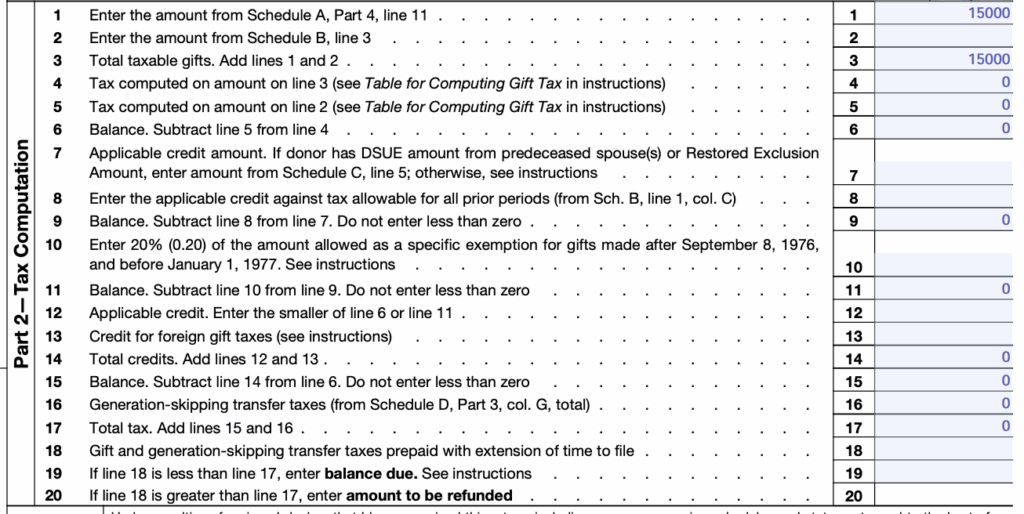

By using the Illinois Form for 529 Plan, you can take advantage of the tax benefits and flexibility offered by a 529 plan. Contributions to a 529 plan are tax-deductible in Illinois, up to certain limits, and earnings grow tax-free when used for qualified education expenses. This can help you maximize your savings and reduce the financial burden of education expenses in the future.

Overall, the Illinois Form for 529 Plan is a crucial document that allows you to open and manage a 529 plan for your child or grandchild’s education. By filling out this form and choosing your investment options carefully, you can start saving for the future and give your loved ones the gift of a quality education.

By following these steps and utilizing the Illinois Form for 529 Plan, you can secure a brighter future for your loved ones and take advantage of the tax benefits and flexibility offered by a 529 plan.

Download Illinois Form For 529 Plan

Michael W Frerichs Illinois State Treasurer College Savings

Superfund 529 Plan White Coat Investor