Income-Driven Repayment Plans are a valuable option for borrowers struggling to make their student loan payments. These plans adjust your monthly payment based on your income and family size, making it more manageable for you to stay current on your loans. To apply for an Income-Driven Repayment Plan, you will need to fill out a specific form provided by your loan servicer.

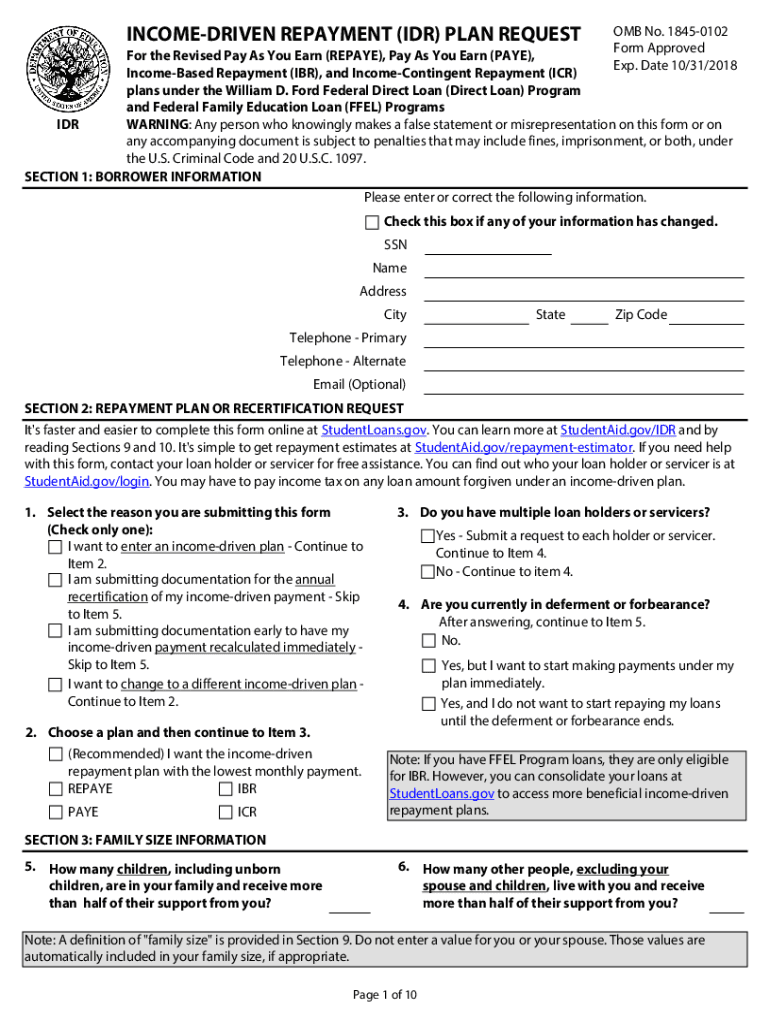

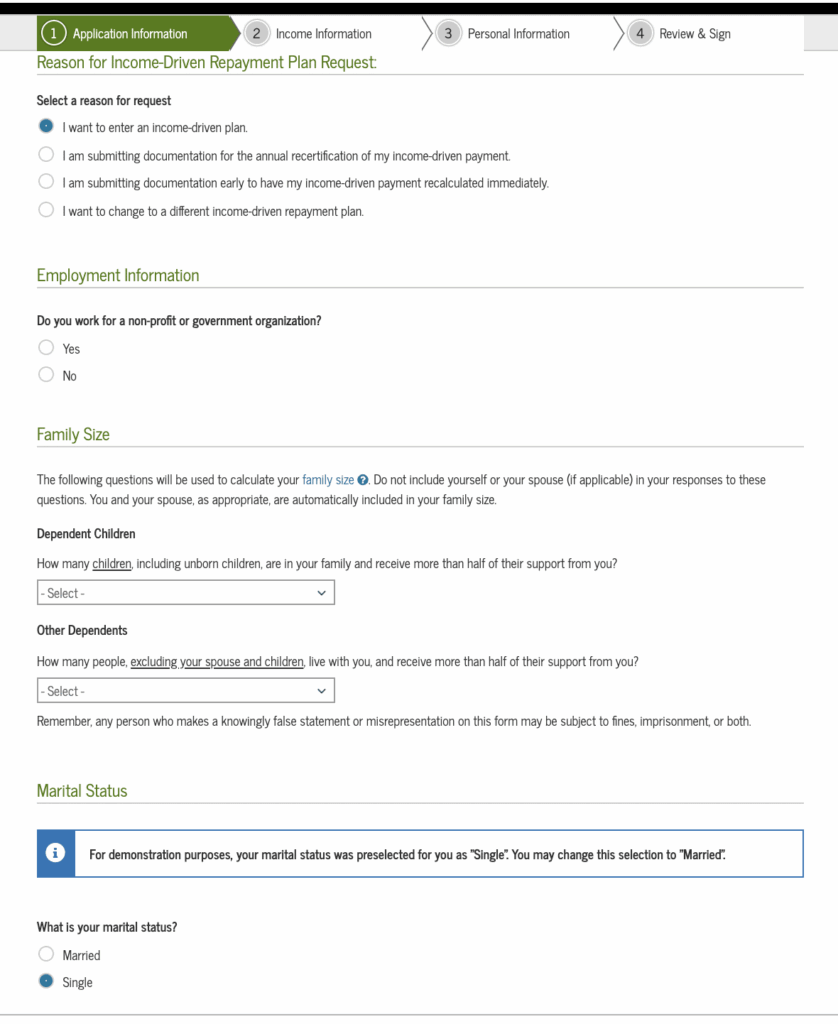

The Income-Driven Repayment Plan Form collects information about your income, family size, and any other factors that may affect your ability to make loan payments. This information is used to calculate your monthly payment amount under the plan. It is important to accurately fill out the form to ensure that your monthly payment is affordable for your financial situation.

Income-driven Repayment Plan Form

How to Fill Out the Income-Driven Repayment Plan Form

When filling out the Income-Driven Repayment Plan Form, be sure to have all necessary documentation on hand, such as tax returns, pay stubs, and any other proof of income. Provide accurate information about your income and family size to ensure that your monthly payment is calculated correctly. Once you have completed the form, submit it to your loan servicer for review and approval.

Conclusion

Income-Driven Repayment Plans offer a lifeline to borrowers struggling with high student loan payments. By filling out the Income-Driven Repayment Plan Form accurately and submitting it to your loan servicer, you can take advantage of this valuable option to make your loan payments more manageable. Be sure to stay current on your payments and reapply for the plan as needed to continue benefiting from its advantages.