When starting a new business, one of the most crucial decisions you will need to make is choosing the right legal form of ownership. The legal structure you choose will have significant implications for how your business operates, how it is taxed, and how you are personally liable for its debts and obligations. It is essential to carefully consider the options available and select the form of ownership that best aligns with your business goals and objectives.

There are several common legal forms of ownership to choose from, including sole proprietorship, partnership, corporation, and limited liability company (LLC). Each form has its advantages and disadvantages, and the best choice for your business will depend on factors such as your industry, size, and growth plans. Consulting with a legal or financial advisor can help you navigate the complexities of each option and make an informed decision.

Legal Form Of Ownership Business Plan

Sole Proprietorship

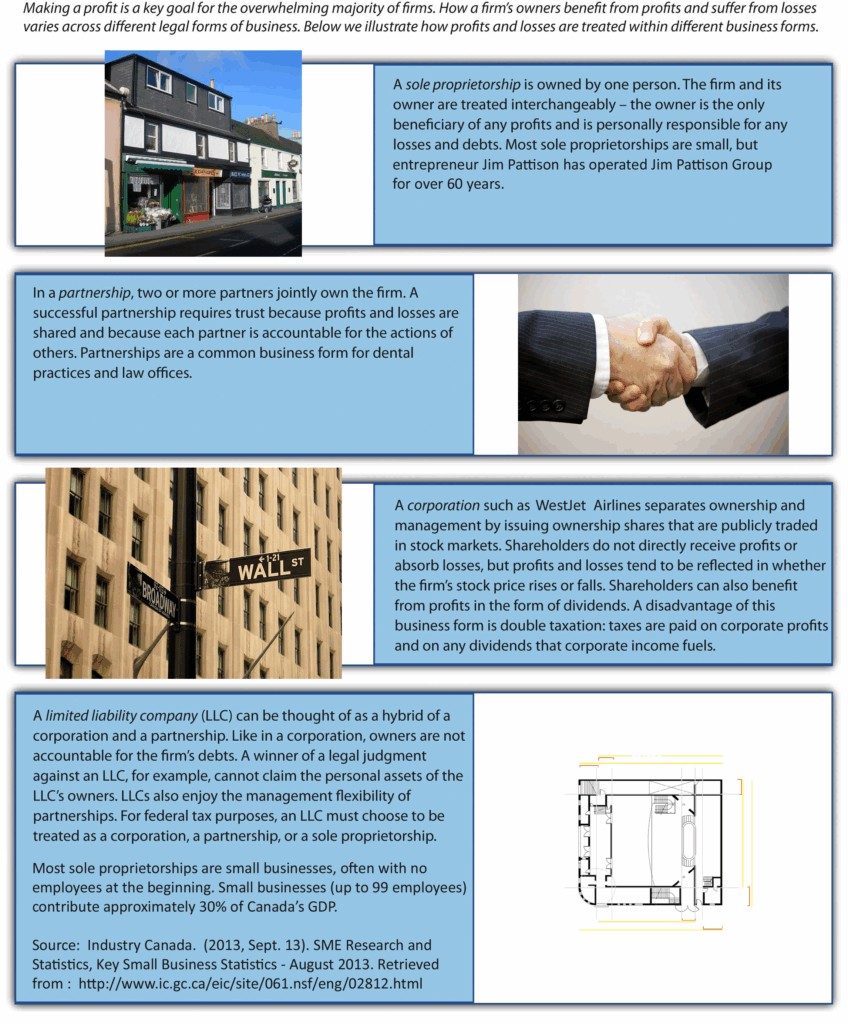

A sole proprietorship is the simplest form of ownership and is suitable for small businesses with one owner. In this structure, the business and the owner are considered one entity, which means that the owner has full control over decision-making and receives all profits. However, the owner is also personally liable for the business’s debts and obligations, which can put their personal assets at risk. Sole proprietorships are easy to set up and maintain but may limit growth opportunities and access to funding.

Partnership

A partnership is a legal form of ownership where two or more individuals share ownership of a business. There are several types of partnerships, including general partnerships, limited partnerships, and limited liability partnerships. In a partnership, the owners share profits, losses, and decision-making responsibilities. Partnerships offer more flexibility than sole proprietorships and can benefit from shared resources and expertise. However, partners are personally liable for the business’s debts, and disagreements among partners can complicate decision-making.

Corporation

A corporation is a separate legal entity from its owners, known as shareholders. Corporations offer limited liability protection, meaning that shareholders are not personally liable for the business’s debts and obligations. Corporations have a more complex structure and are subject to more regulations and formalities than other forms of ownership. However, corporations have access to more funding options, can issue stock to raise capital, and have greater tax advantages. Corporations are ideal for businesses with high growth potential and multiple owners.

Limited Liability Company (LLC)

An LLC is a hybrid form of ownership that combines the limited liability protection of a corporation with the flexibility and tax benefits of a partnership. LLCs are relatively easy to set up and maintain and offer personal liability protection for owners. LLCs can choose how they are taxed, either as a pass-through entity or as a corporation. This form of ownership is popular among small businesses seeking liability protection and tax advantages while maintaining flexibility in management and decision-making.

In conclusion, selecting the right legal form of ownership is a critical step in developing a successful business plan. Each form has its pros and cons, and the best choice will depend on your specific circumstances and goals. By carefully considering your options and seeking professional advice, you can ensure that your business is structured in a way that maximizes its potential for success while minimizing risk and liability.

Download Legal Form Of Ownership Business Plan

Legal Forms Of Business

Legal Forms Of Business Mastering Strategic Management 1st Canadian Edition