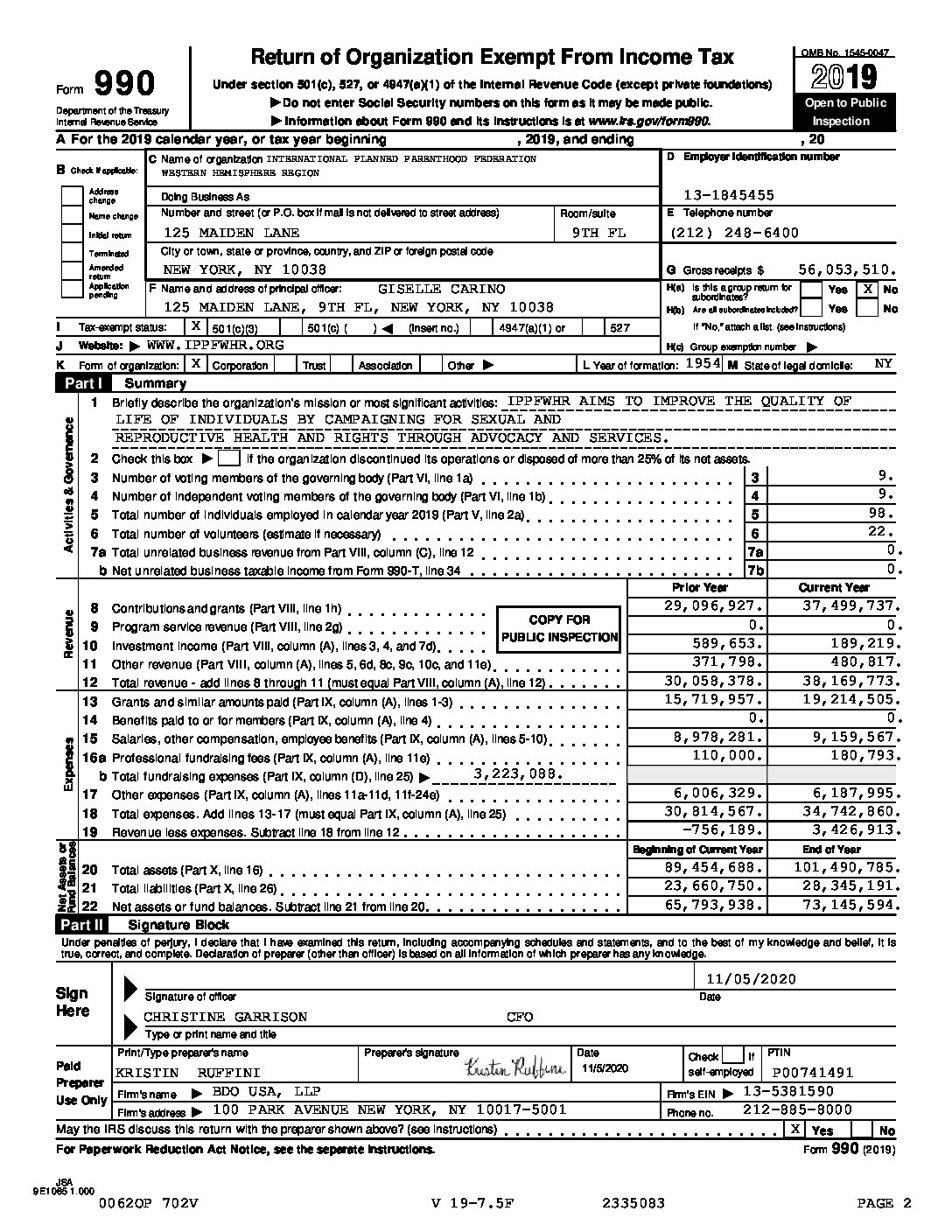

Planned Parenthood is a non-profit organization that provides reproductive healthcare services to millions of individuals across the United States. As a non-profit entity, Planned Parenthood is required to file an annual tax form known as Form 990 with the Internal Revenue Service (IRS). The Form 990 provides detailed information about the organization’s finances, governance, and mission.

When looking for information about Planned Parenthood’s tax status, individuals can access their Form 990 on the organization’s website or through the IRS’s online database. This form is a public document and provides transparency about how Planned Parenthood operates and manages its funds.

Planned Parenthood Tax Form

Importance of Reviewing Planned Parenthood Tax Form

Reviewing Planned Parenthood’s tax form can provide valuable insights into how the organization allocates its resources and funds its programs. By examining the Form 990, individuals can see details about Planned Parenthood’s revenue sources, expenses, and executive compensation.

For donors and supporters of Planned Parenthood, reviewing the tax form can help ensure that their contributions are being used effectively and in line with the organization’s mission. Transparency and accountability are key principles for non-profit organizations, and accessing the tax form is one way to hold Planned Parenthood accountable for its actions.

Conclusion

Understanding Planned Parenthood’s tax form is essential for donors, supporters, and the general public to have insight into how the organization operates and manages its finances. By reviewing the Form 990, individuals can ensure that Planned Parenthood is fulfilling its mission and using its resources responsibly. Transparency and accountability are crucial for non-profit organizations like Planned Parenthood, and the tax form is a valuable tool for achieving these goals.