Retirement planning is a crucial aspect of financial stability in later years. To ensure a comfortable retirement, it’s essential to contribute to a retirement plan regularly. Pershing offers a variety of retirement plan options to help individuals save for their golden years. One important aspect of contributing to a retirement plan with Pershing is filling out the necessary forms, such as the Retirement Plan Contribution Form.

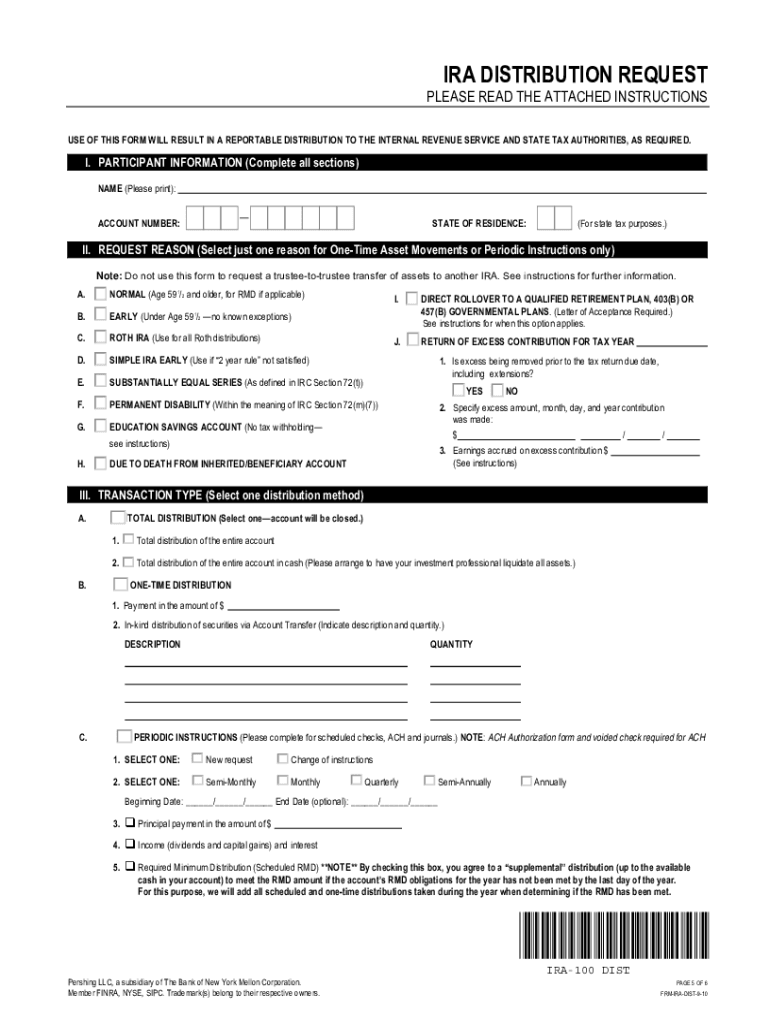

The Retirement Plan Contribution Form is a document that allows individuals to specify how much money they want to contribute to their retirement account. This form typically includes information such as the individual’s name, account number, contribution amount, and frequency of contributions. By filling out this form accurately and timely, individuals can ensure that their retirement savings are growing steadily over time.

Retirement Plan Contribution Form Pershing

How to Fill Out the Retirement Plan Contribution Form

When filling out the Retirement Plan Contribution Form with Pershing, individuals should carefully review the form instructions and provide accurate information. It’s important to double-check all details, such as contribution amounts and account numbers, to avoid any errors that could impact retirement savings. Once the form is completed, individuals can submit it to Pershing through their preferred method, such as online submission or mail.

Conclusion

Contributing to a retirement plan with Pershing is a smart investment in one’s future financial security. By filling out the Retirement Plan Contribution Form accurately and timely, individuals can ensure that their retirement savings are on track to meet their financial goals. It’s important to stay informed about retirement plan options and take advantage of employer-sponsored retirement plans or individual retirement accounts to maximize savings for retirement.