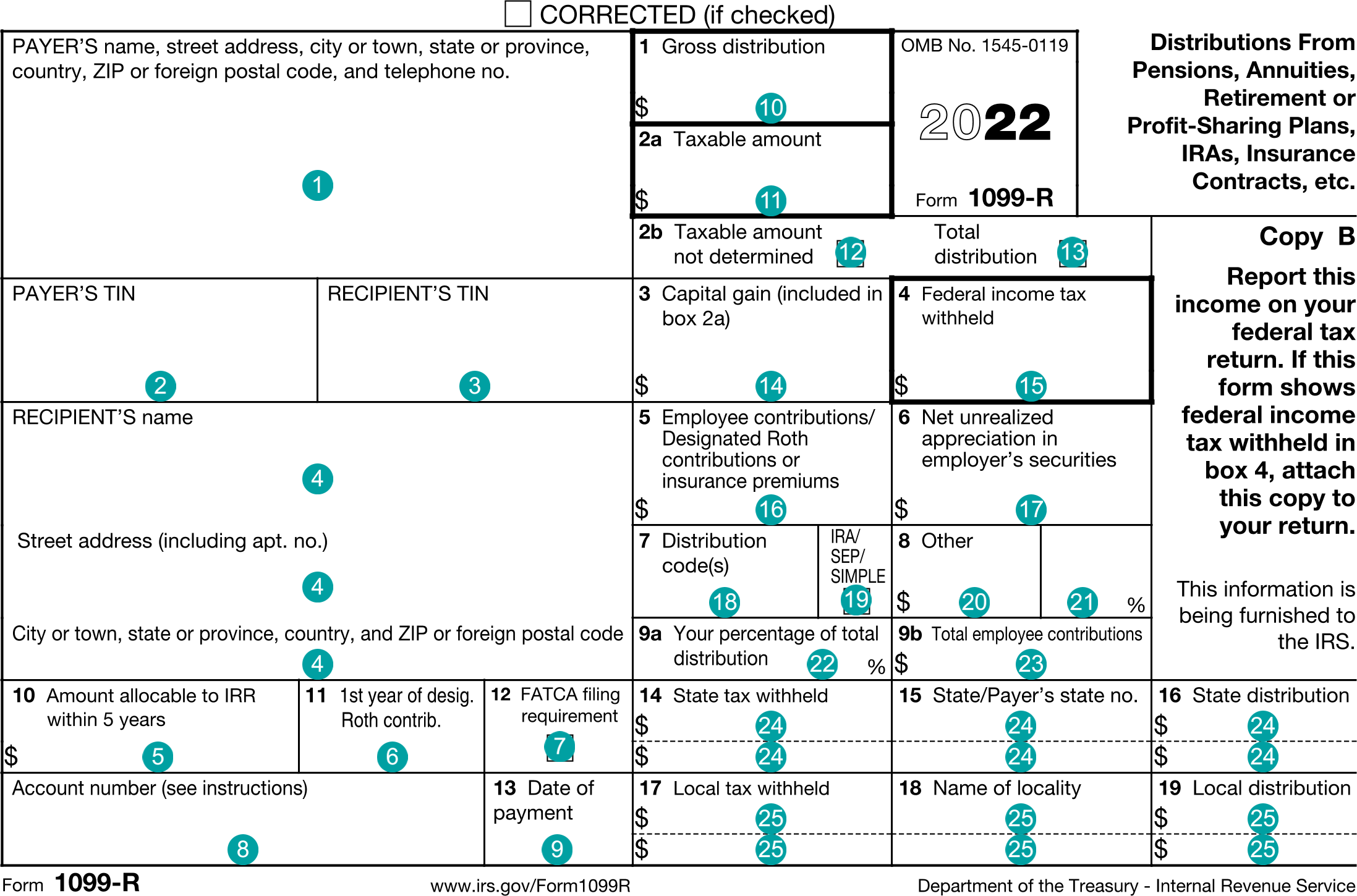

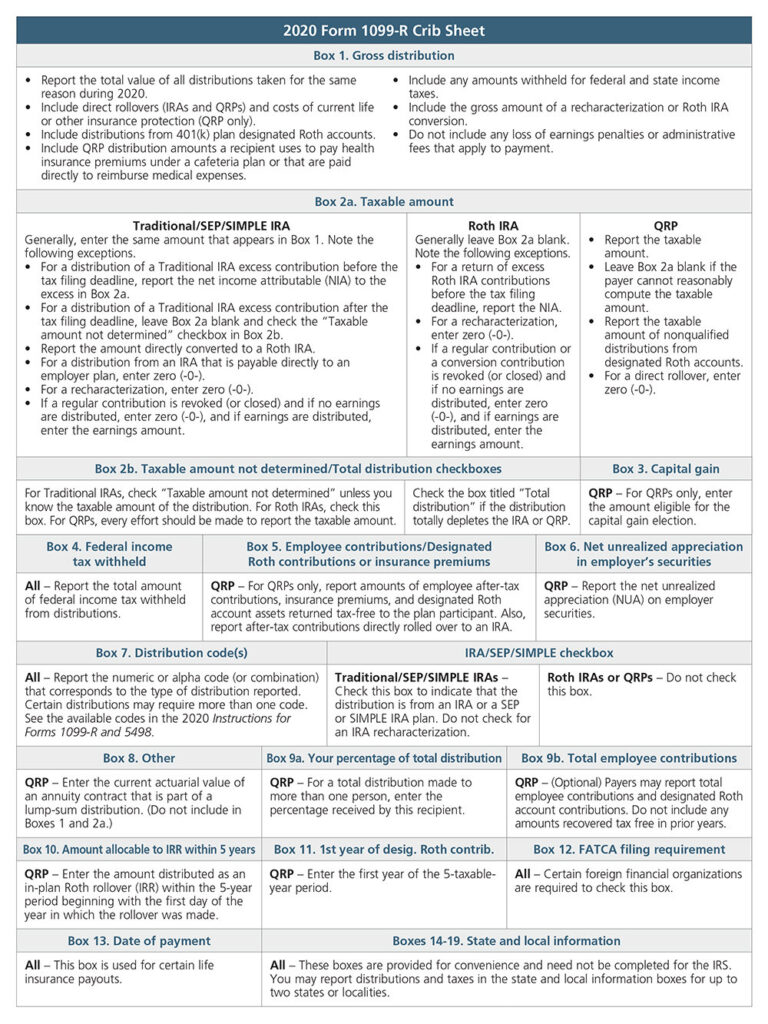

When you retire and start taking distributions from your retirement plan, you will likely need to fill out a tax form to report these distributions to the IRS. The retirement plan distribution tax form, typically Form 1099-R, is used to report distributions from retirement plans such as 401(k)s, IRAs, and pensions. This form provides important information about the amount of money you received from your retirement plan and any taxes that were withheld.

It is important to note that not all retirement plan distributions are subject to the same tax treatment. Some distributions may be taxable, while others may be tax-free. It is crucial to understand the tax implications of your retirement plan distributions to avoid any surprises come tax time.

Retirement Plan Distribution Tax Form

Completing the Retirement Plan Distribution Tax Form

When you receive a distribution from your retirement plan, the plan administrator will typically send you a Form 1099-R detailing the amount of the distribution and any taxes that were withheld. You will need to use this form when filing your taxes for the year in which the distribution was received.

On the tax form, you will need to report the total amount of the distribution, the amount of any taxes withheld, and any additional information required by the IRS. Depending on the type of retirement plan you have and the nature of the distribution, you may need to report the distribution as taxable income on your tax return.

Seeking Professional Help

Given the complexities of retirement plan distributions and the tax implications involved, it is always a good idea to seek professional help when filling out your retirement plan distribution tax form. A tax professional or financial advisor can help you navigate the tax rules and ensure that you are accurately reporting your retirement plan distributions to the IRS.

By understanding the requirements of the retirement plan distribution tax form and seeking professional guidance when needed, you can ensure that you are compliant with tax laws and maximize the tax benefits of your retirement plan distributions.