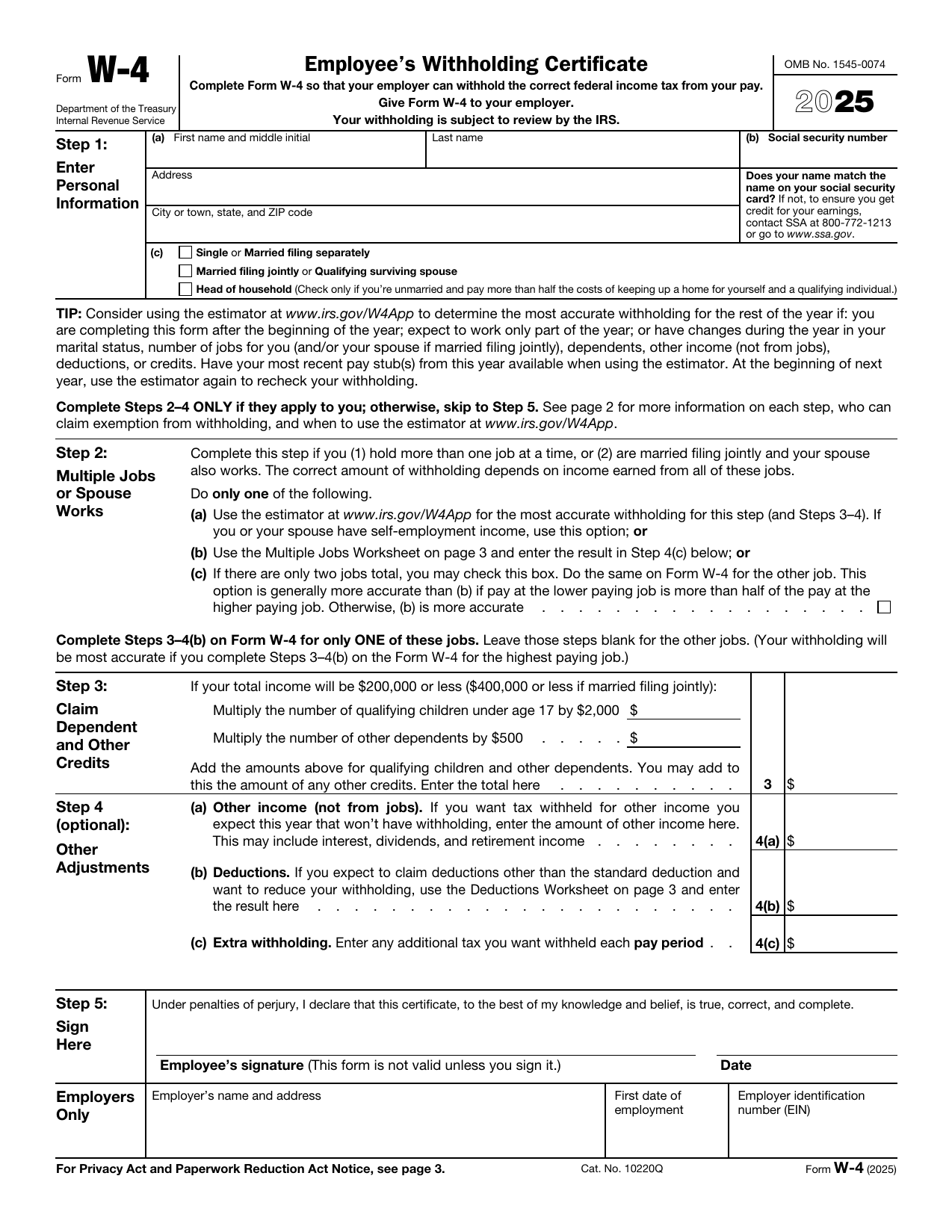

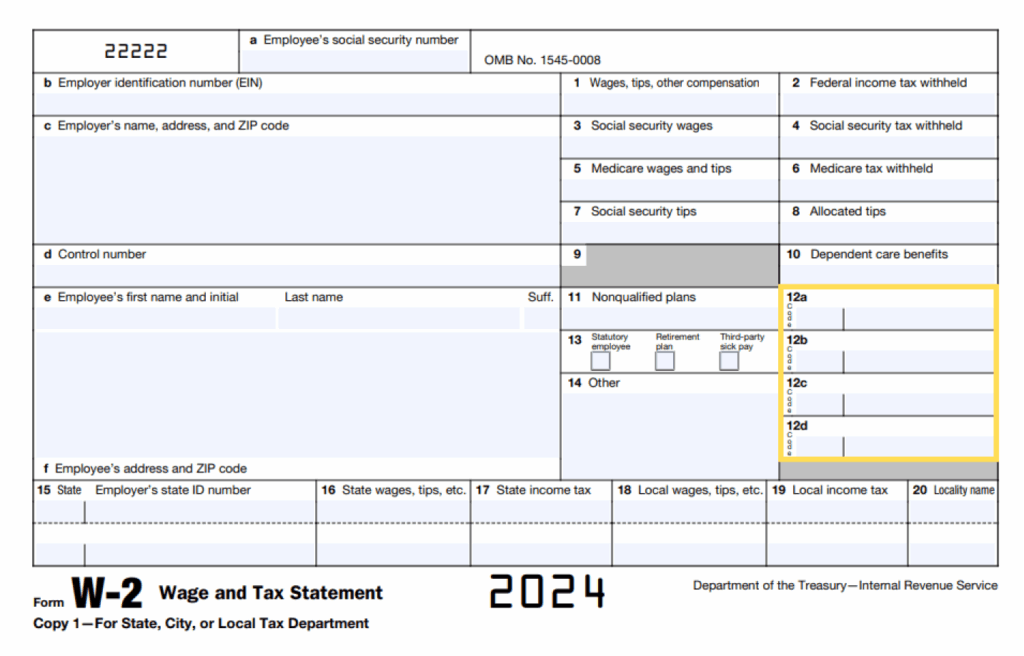

A Tax Forms Essential Plan is a comprehensive package that includes all the necessary tax forms and documents needed for individuals or businesses to file their taxes accurately and efficiently. This plan typically includes forms such as W-2s, 1099s, 1040s, and various schedules and worksheets required by the IRS.

By opting for a Tax Forms Essential Plan, taxpayers can ensure that they have all the necessary documents in one convenient package, making the tax filing process much simpler and less stressful. These plans are often offered by tax preparation services or online tax software providers.

Tax Forms Essential Plan

Benefits of using a Tax Forms Essential Plan

1. Convenience: Having all the necessary tax forms in one package saves time and eliminates the need to search for individual forms online or at the IRS office.

2. Accuracy: By using a Tax Forms Essential Plan, taxpayers can reduce the risk of errors in their tax filings, as all the required forms are included and organized in a structured manner.

3. Compliance: By ensuring that all the necessary tax forms are included in the plan, taxpayers can avoid penalties and fines for missing or incorrect information on their tax returns.