Manulife Plan Member Claim Form – An ERISA Segment 502(a) plan could be claimed in a range of approaches. For dental and medical providers, boasts kinds can be purchased. Your medical provider will expect you to full and publish these state reports to UnitedHealthcare. To save you time, state kinds can easily be bought within the places of work of countless contributing service providers. After doing the shape, you might send out it right to UnitedHealthcare. If you need help filling out your form, Visit your health insurance representative or contact UnitedHealthcare.

Assert Type for ERISA Portion 502(a) Plans

A unique period of time must complete before publishing an ERISA Section 502(a) program state form. Within this time period, a fiduciary task claim or gain denial declare must be created. Federal and state legal guidelines normalize ERISA area 502(a) statements.

If you don’t adhere to this timeline, the EBSA will levy a civil fine on you. The civil good is calculated being a portion of the plan’s disgorged profits and losses. The fiduciaries, who are accountable for make payment on good, may be held responsible for it.

Review the claim form to make sure it complies with ERISA regulations if you have a plan that does. A place exclusion supply could be incorporated into a plan. With your SPD and in your telecommunications with contributors, ensure that you point out the area restriction. However, you should refrain from saying anything unnecessarily since it can be used against you in court. In virtually any celebration, make sure you consult with the legal advice for the decide to guarantee agreement.

Five percent of your sum at concern is the punishment sum. If you miss the payment deadline, you may, however, ask for a penalty waiver. If a fine is excessively high, it is not waived. You should pay the penalty if you can pay it. It ought to be paid out within 60 days. The EBSA will issue a revised penalty notice if you miss the deadline.

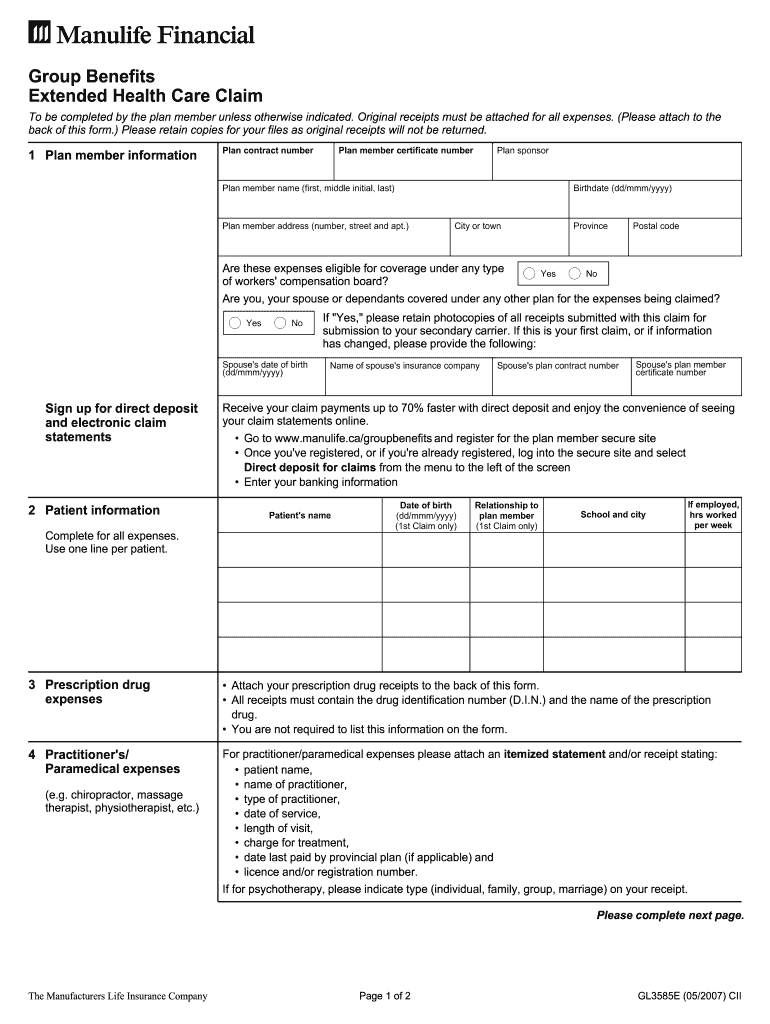

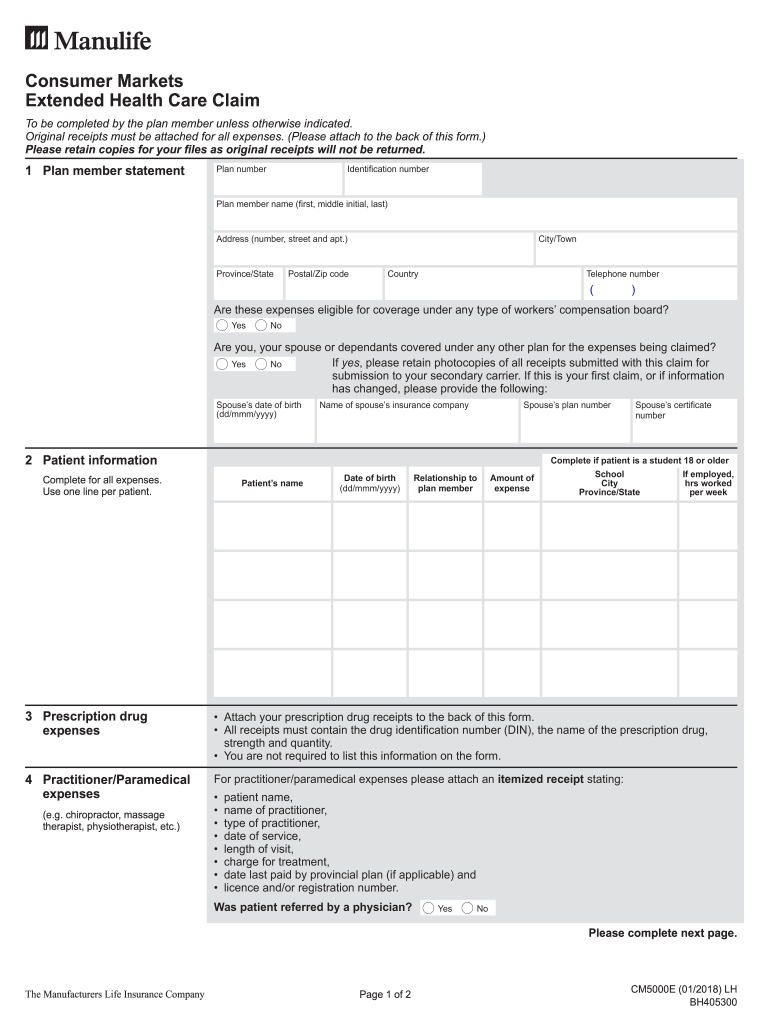

Type for medical treatment statements

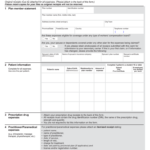

You have to consist of all essential specifics when submitting a medical providers declare. As an illustration, you have to range from the service’s time as well as position. If you are filing a claim from outside the country, you must also attach documentation of travel. You are able to ask for help from your health attention provider’s payment section. In order to record all medical costs, section D must also be completed.

UnitedHealthcare will provide the assert develop towards the medical professional. It needs to be recently and accurately filled in. To accept the transaction, the dealer will need to have a current Taxes Detection Amount. The form is also accessible in the provider’s business office. For the insurer to immediately pay the provider, you must be sure that they have a existing Taxes Identification Number.

Most of the containers with this develop can also be located on the CMS-1500 form. It need to consist of details on the sufferer, the specialist, the course of treatment method, as well as any other appropriate details. It’s crucial to adhere to the insurance provider’s guidelines in order to minimize errors and increase your chances of getting paid. It is preferable if you provide more details. For instance, you should note on the form if the patient was engaged in a car accident.

If you need to file a claim for medical services, fill out a CMS-1500. To ensure so that it is approved, it has to consist of all relevant particulars in regards to the injured celebration. A duplicate in the done type needs to be made available to the individual, the patient’s legal professional, the worker’s reimbursement insurance carrier, the business or personal-covered with insurance boss, and also the workplace. The Workers’ Payment Board develop has become replaced with the CMS-1500.

state develop to get a dentistry strategy

If the entire fee is not covered by insurance in New York, the dentist may report it on a Dental Plan Claim Form. Unless the sufferer gets a discount from the insurance company, the dental professional will charge the individual the entire fee in advance. If the patient has a secondary insurance plan and no dental insurance, the dentist can only report the fee that is not covered by the insurance plan.

An insurance claim type for a dentistry plan contains 3 elements. The first is for the policyholder and features theaddress and name, and birthdate of your covered participant. The dental plan must answer the questions in the second part before approving a claim. The patient’s profession and academic backdrop, and also other specifics that could aid the insurance company in handling the state, are thorough from the third aspect.